Interesting to note today that although the QQQ did manage to gap above the aforementioned consolidation zone, it did so virtually SOLELY as the result of MSFT’s big pre-market induced pop on news that Steve Ballmer plans to retire in the next 12 months. First of all, not the kind of news that warrants a nearly 9% gain in such a massive mega-cap company and secondly, the fact that MSFT is only one of three of the top ten holdings in the QQQ actually trading positive today. Keep in mind that the top ten holdings in the QQQ make up literally half the gains of that index tracking etf. That alone is a warning sign that this breakout is not very likely to stick unless we see breadth start to improve with some other stocks in the index begining to participate in the rally. It’s also worth noting that MSFT did (so far) stop cold and reversed at the expected resistance level (dotted line) posted yesterday.

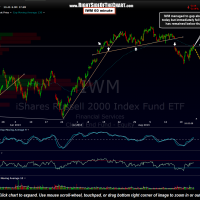

Putting the QQQ aside, so far the SPY has stopped cold at the resistance line defined by the July 11th gap while the IWM managed to gap above it’s key resistance line (largely due to the pre-market momentum given to the futures from MSFT’s news) but that gap was immediately faded and IWM fell right back below the resistance level and has remained below so far today. My primary scenario still has a resumption of the current short-term downtrend beginning as soon as this oversold bounce runs it’s course. My best guess is that we are at or near that point but we’ll just have to wait to see what the rest of the day brings although being that it’s Friday, this story just might have to be continued next week. The bottom line is that the US markets still have significant overhead resistance levels to content with on the intraday charts while the long-term technicals continue to indicate that more downside is likely over the next few weeks to months.