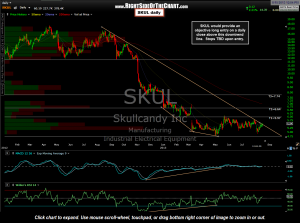

SKUL will offer an objective long entry on a daily close above this downtrend line. Keep in mind that with the bearish divergences, extreme bullish sentiment and other recent conditions that have elevated the risk of a broad sell-off in equities, long-side breakouts may be more prone to a higher risk of failure right now. However, one of the main objectives of RSOTC is to post the best looking trade setups, long and short, regardless of my own current positioning or market bias.

SKUL will offer an objective long entry on a daily close above this downtrend line. Keep in mind that with the bearish divergences, extreme bullish sentiment and other recent conditions that have elevated the risk of a broad sell-off in equities, long-side breakouts may be more prone to a higher risk of failure right now. However, one of the main objectives of RSOTC is to post the best looking trade setups, long and short, regardless of my own current positioning or market bias.

With that being said, SKUL may possibly be in the final stages of pounding out a bottom but I can also see the possibility of one additional thrust to new lows, quite possibly to the bottom of the lower wedge line (if it were extended) before a lasting bottom is put in. Which scenario (if either) plays out will largely depend on how the broad market performs over the next several months. Daily chart shown.