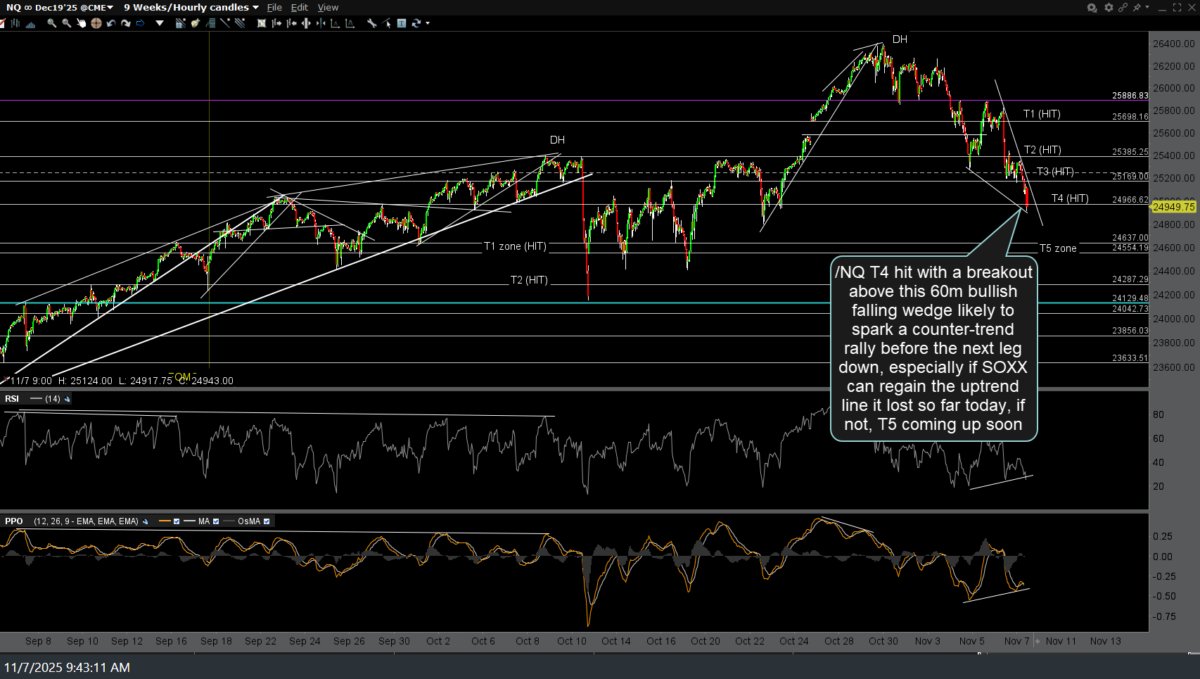

Some of the servers went down on my primary charting platform shortly after the open today so once back online, I’ll follow up with some additional price levels to watch on QQQ, SPY, and/or SOXX today. I also expanded on my thoughts regarding the broad market in replies to a few comments this morning which can be viewed on RSOTC.com. Until then, here are my thoughts & updated chart on /NQ (Nasdaq 100 futures) along with the previous (Friday’s) & updated 60-minute charts.

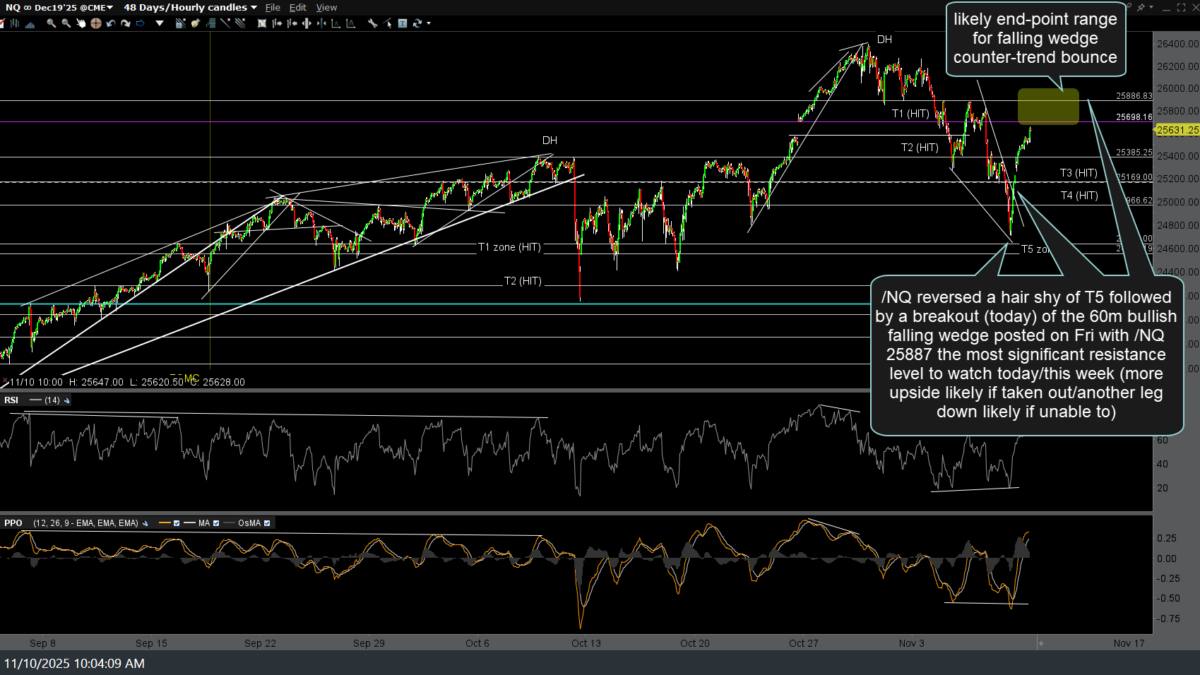

/NQ reversed a hair shy of my fifth and final ‘near-term’ target zone (T5) followed by a breakout (today) of the 60-minute bullish falling wedge posted on Fri with 25,887 the most significant resistance level to watch today/this week (more upside likely if taken out/another leg down likely if unable to). With the recent sell signals (primary & secondary trendline breakdowns) still intact on the more significant QQQ daily time frame, my expectation is this is most likely a technically induced (60-minute bullish falling wedge breakout + /NQ coming within a hair of my final NEAR-TERM downside target ((where a decent reaction was likely + near-term (intraday charts) oversold readings/bounce.))

However, as stated earlier, a solid recovery & close back above the primary uptrend line on SOXX can be viewed as nothing but a bullish development, until & unless SOXX clearly loses that trendline again (whipsaw following a whipsaw).

Bottom line: Nothing (at this time) has changed in my intermediate to longer-term outlook for QQQ (still bearish/more downside likely), although that can change, depending on how SOXX trades going forward, especially at the close today.

In the shorter/near-term, with my final target on the 60-minute chart of /NQ effectively hit (although not my final target on the QQQ 15-minute chart), the correction off the recent highs could be complete, with a solid recovery back above that 255,887 resistance to increase the odds of another marginal new high in the $NDX. It’s just too hard to say at this time, & as such, my preference is to sit tight on longer-term swing & trend short positions to see how QQQ & SOXX finish trading today & possibly throughout the week.

Updates to follow on some of the individual stock & sector/commodities trade ideas to follow as well once my primary charting platform is back online.