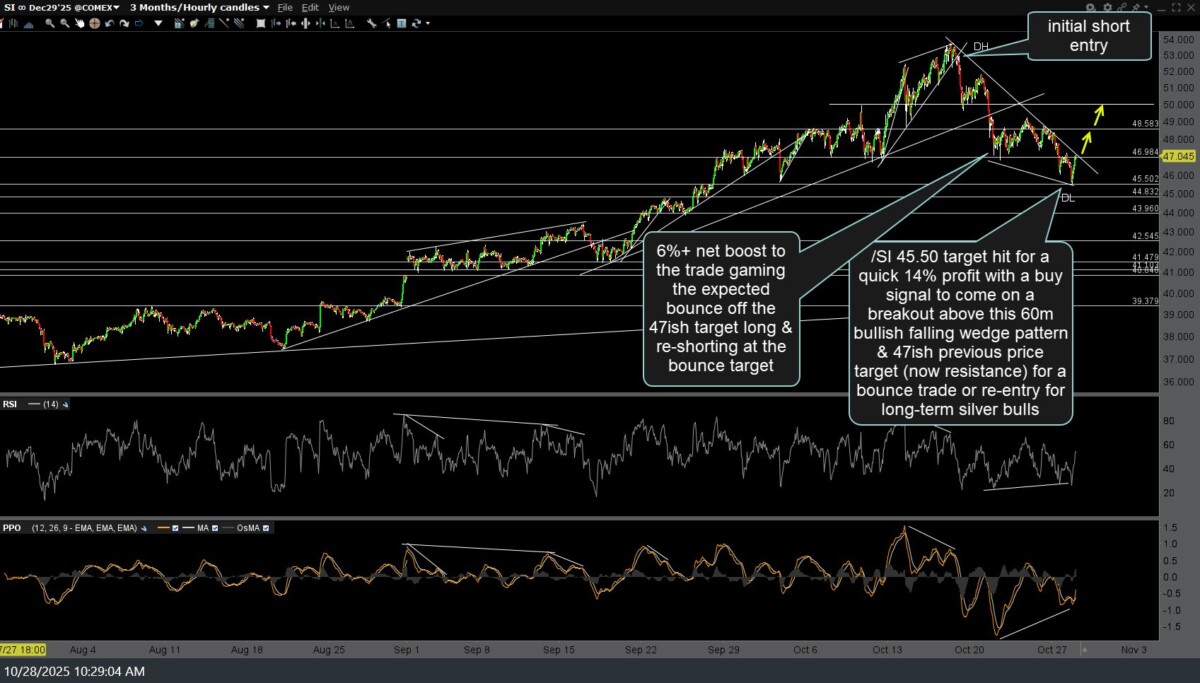

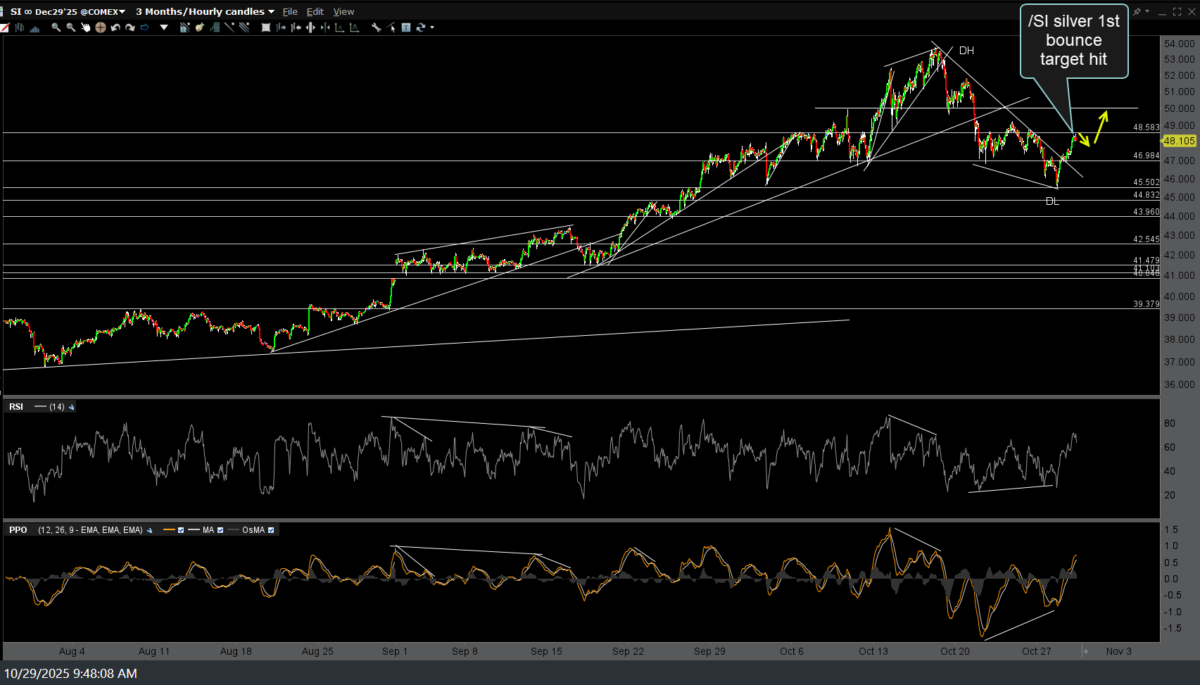

Upon further review of the charts, including the fact that UUP went on to make the expected breakout above T1 while I was out of town on Friday (& EUR/USD broke the 1.155 support), I am removing T2 on the /SI (silver futures or SLV, silver ETF) bounce trade we reversed from short to long last week, with /SI still trading at T1 after hitting it on Thursday. Consider raising stops if holding out for additional gains. The initial short entry/wedge breakdown (shorting /SI just off its ATH) followed by the reversal (cover the short & go long to game the bounce trade). Ditto for the related gold & GDX trades (book profits and/or raise stops and/or reverse back to short for the next leg down, depending on your trading plan). 60-minute charts below.