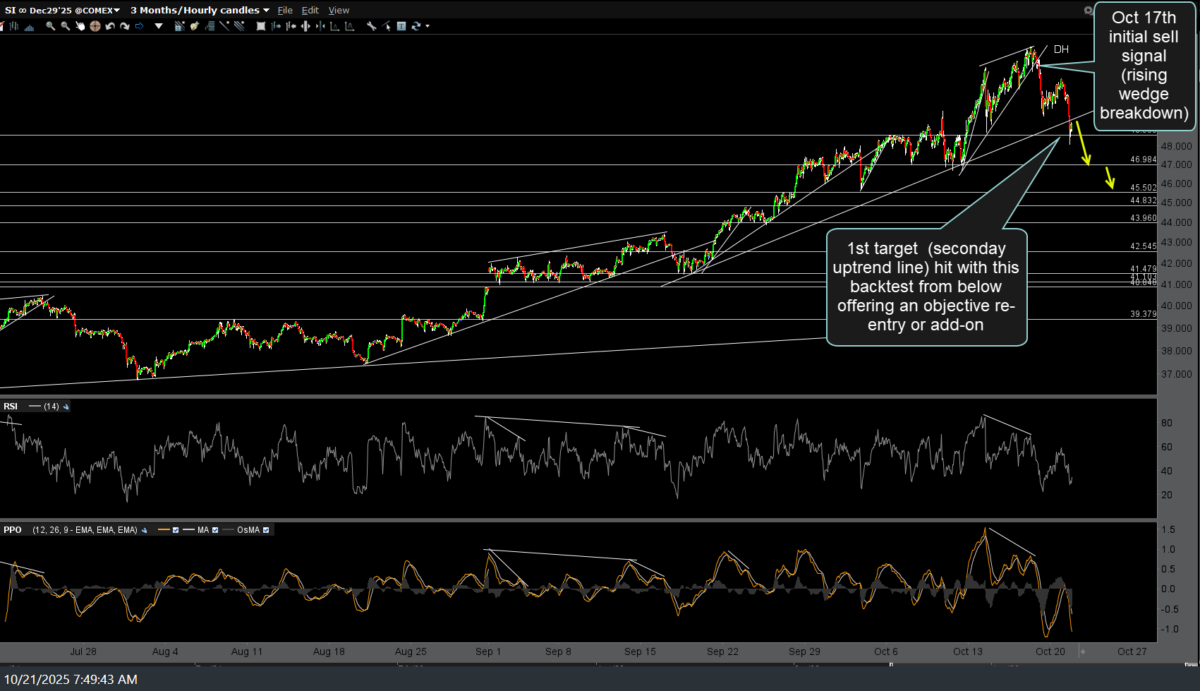

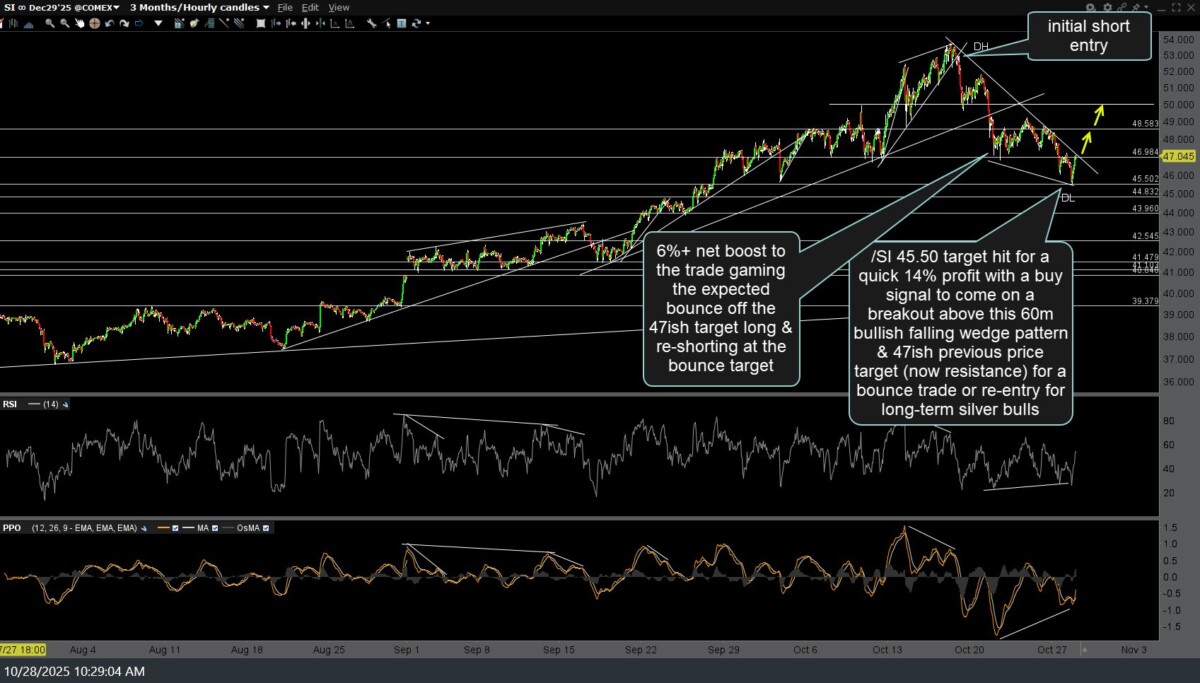

/SI (silver futures) 45.50 target hit for a quick 14% profit (or at least a 20% profit, for those that gamed that predicted bounce long & then back short again off the 47ish target) with a buy signal to come on a breakout above this 60m bullish falling wedge pattern & 47ish previous price target (now resistance) for a bounce trade or re-entry for long-term silver bulls. Previous & updated 60-minute charts below.

For ETF traders, SLV (silver ETF) has also hit my 41.66 target for a quick 14%-20%+ profit. With the odds for a tradable bounce now elevated, this is an objective level for active traders to cover the short & reverse long (with stops somewhat below 41.66) for a bounce trade. Once again, a solid break below this price target/support level increase would increase the odds of another leg down to the primary uptrend line/current final target, so active traders need to stay nimble. Updated 60-minute chart below.