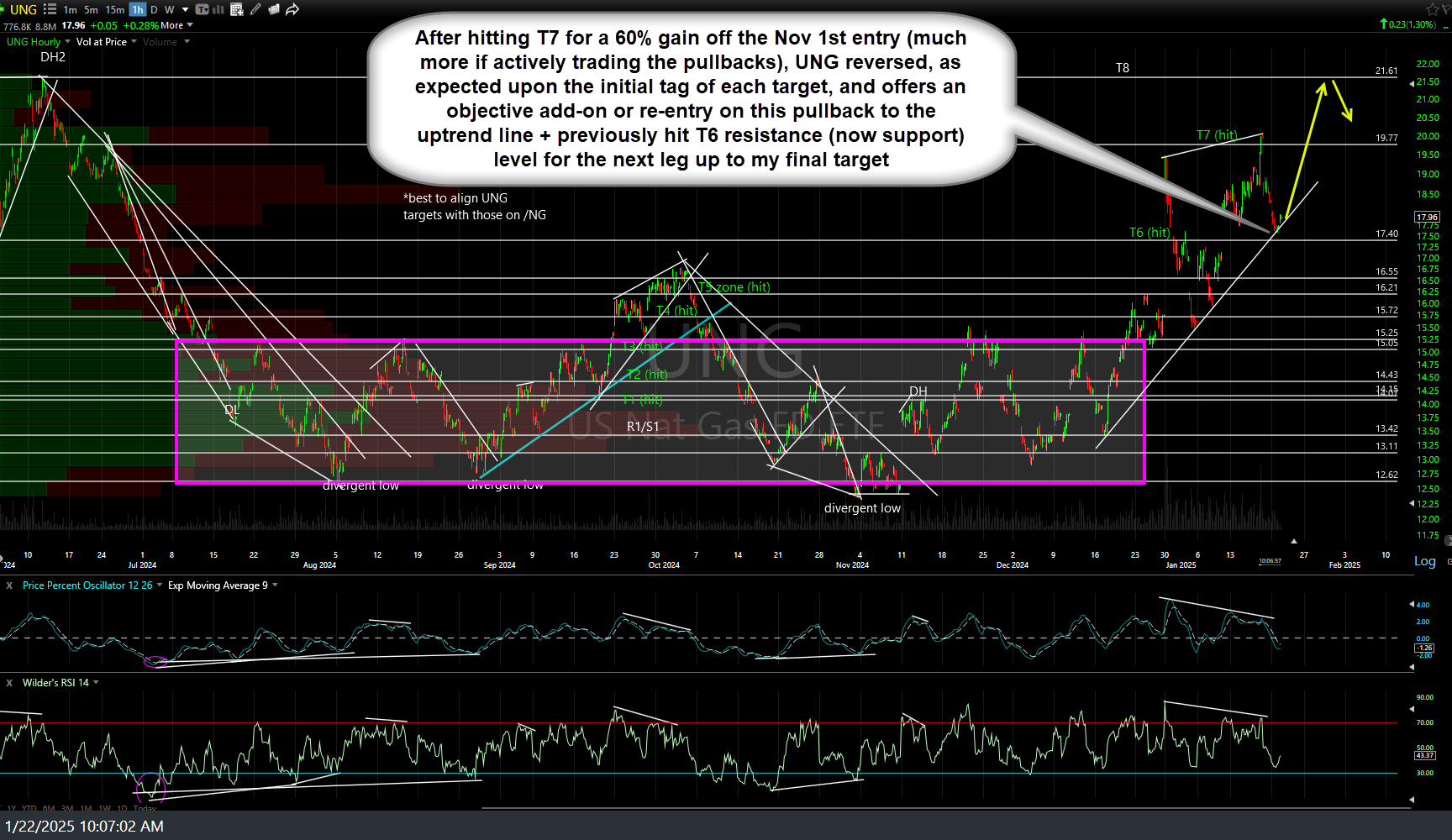

After hitting T7 on Thursday for a 60% profit off the Nov 1st entry (much. much more if actively trading the pullbacks), the UNG (nat gas ETN) long-term swing/trend trade reversed, as expected upon the initial tag of each target, and offers an objective add-on or re-entry on this pullback to the uptrend line + previously hit T6 resistance (now support) level for the next leg up to my final target T8, although best to align the exit on UNG with my final target on /NG, nat gas futures, which remains just shy of the 4.90 resistance level). Previous chart from November 1st, highlighting the objective entry & all 8 price targets, followed by the updated 60-minute chart below.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}