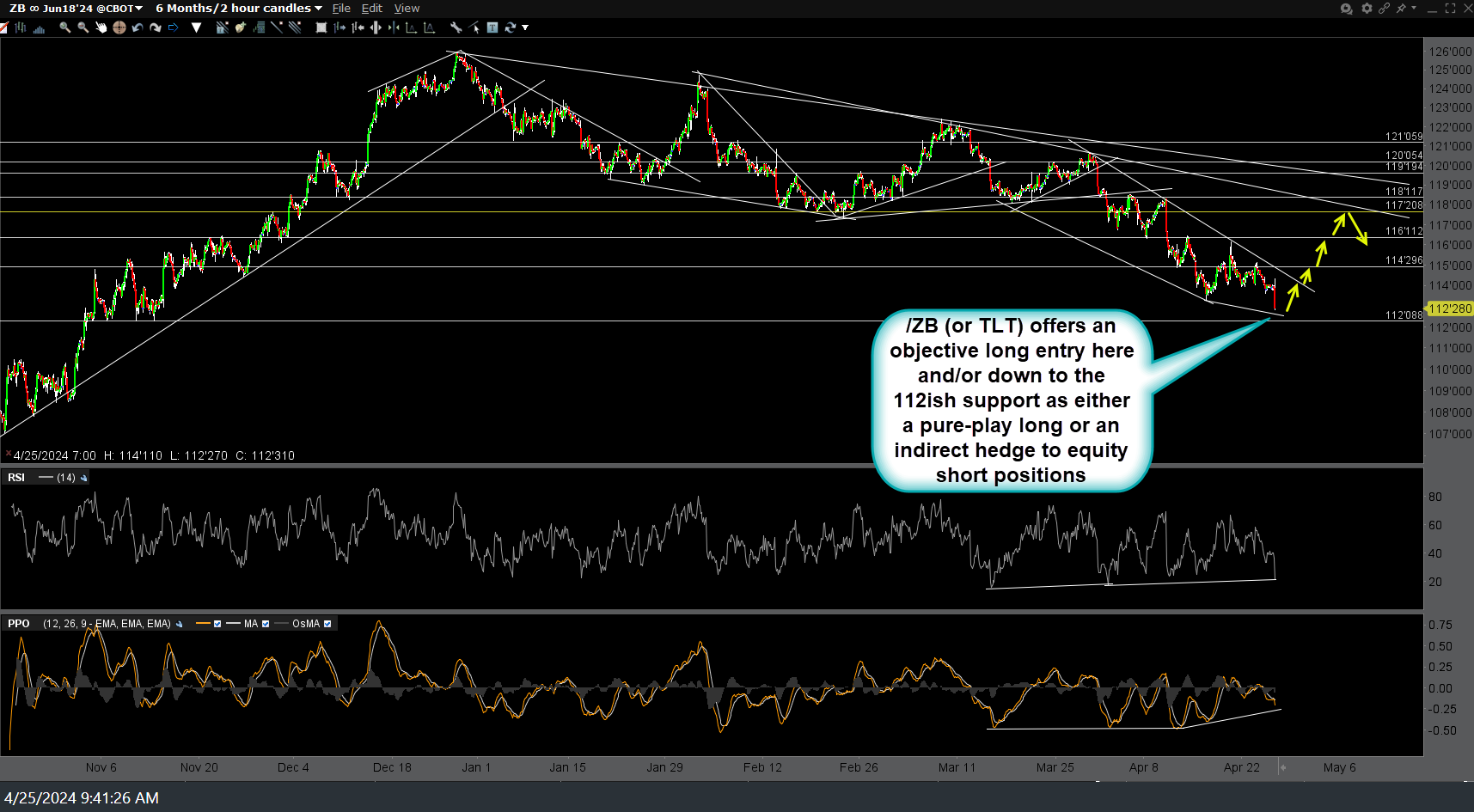

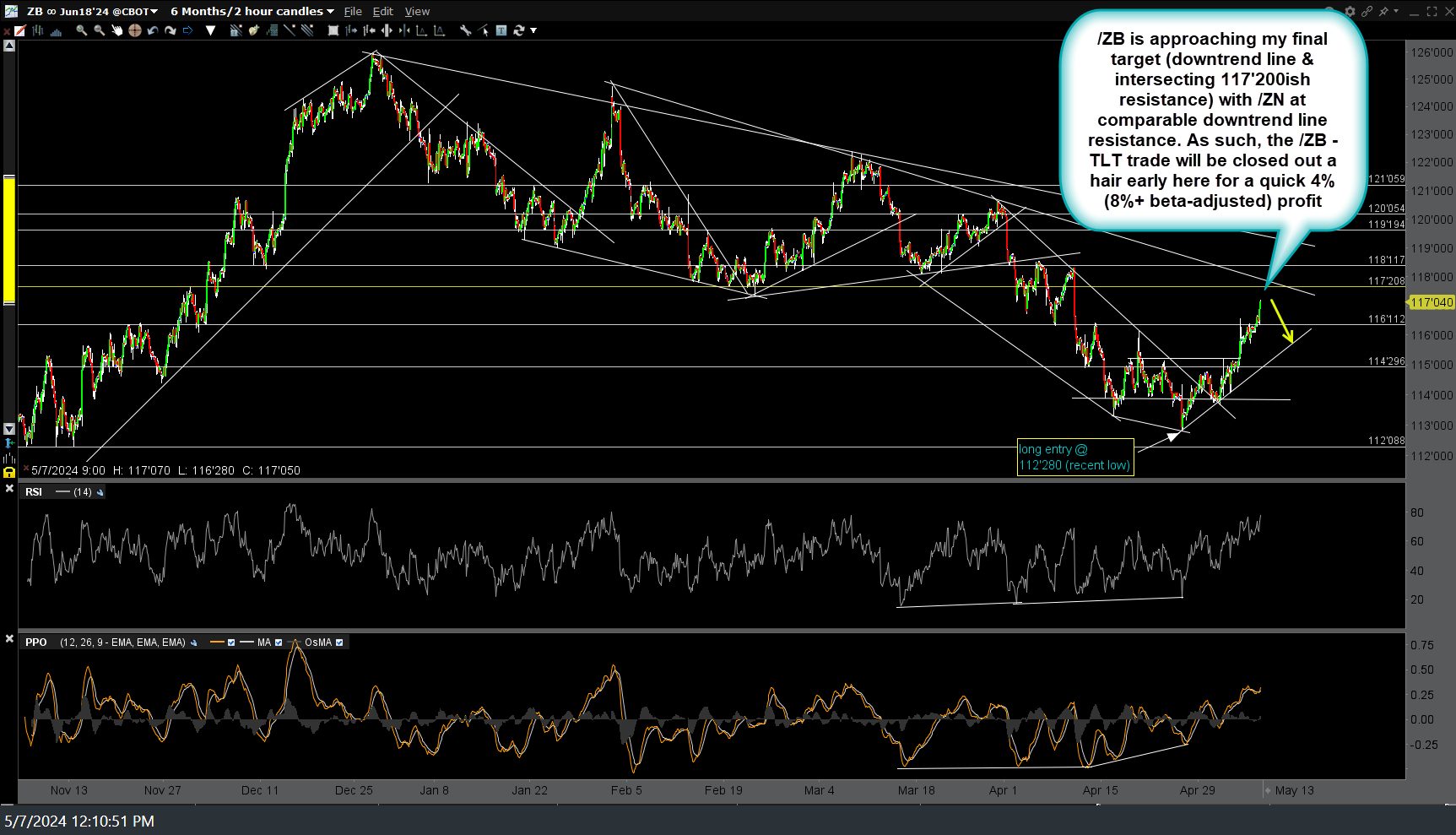

/ZB (30-yr Treasury bond futures) is approaching my final target (downtrend line & intersecting 117’200ish resistance) with /ZN (10-yr Treasury note futures) at comparable downtrend line resistance. As such, the /ZB – TLT trade will be closed out a hair early here for a quick 4% (8%+ beta-adjusted) profit as the R/R to try and milk out that last fraction of a percent is overshadowed by the risk of a sudden reversal is the sellers on /ZN (IEF) step in here, which will likely take /ZB (TLT) down with it. Initial (April 25th entry) & updated 120-minute charts of /ZB below followed by the updated 120-minute chart of /ZN (IEF and TLT were both covered in the video posted earlier today).

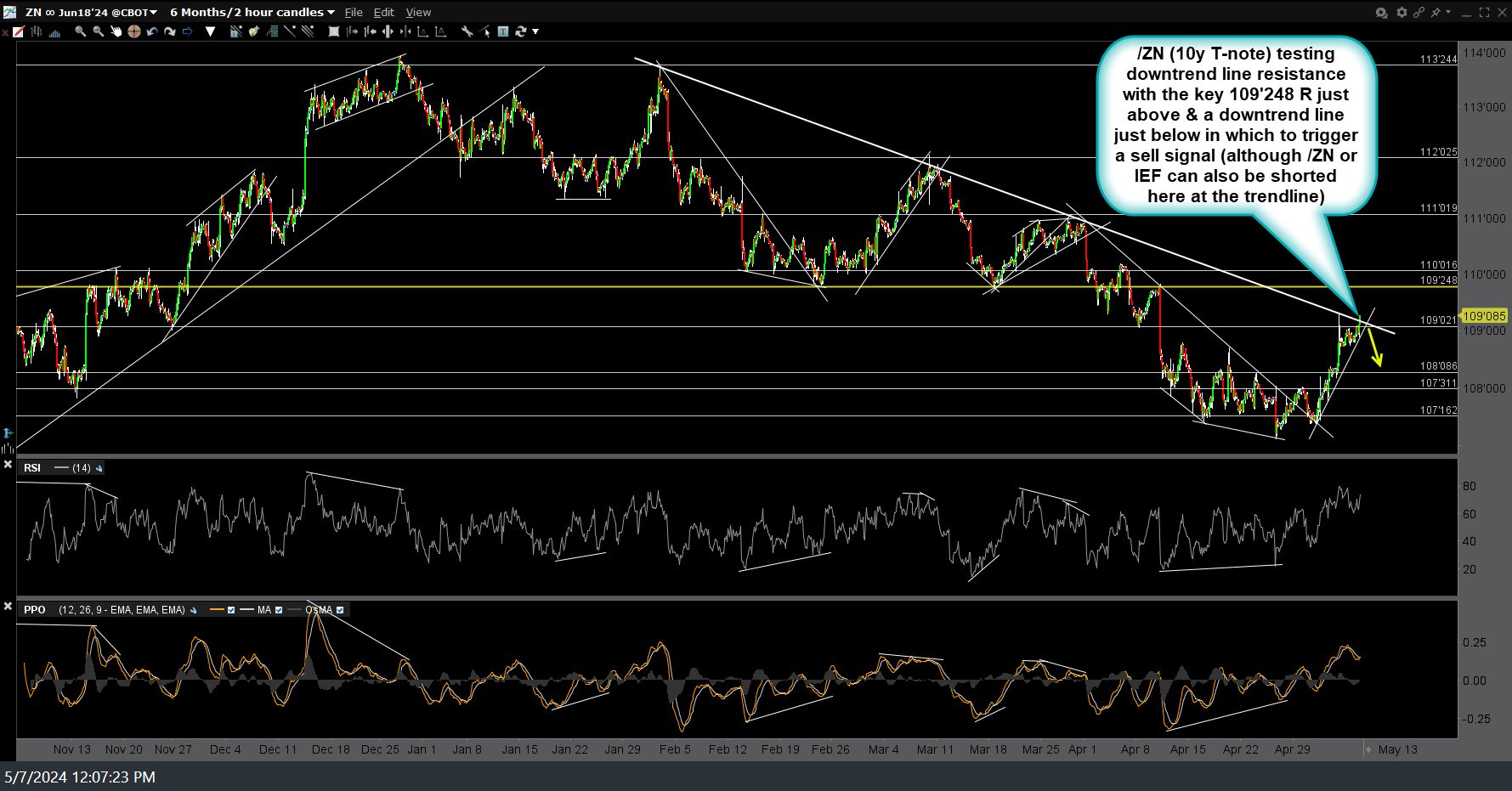

/ZN (10y T-note) is currently testing downtrend line resistance with the key 109’248 resistance just above & a downtrend line just below in which to trigger a sell signal (although /ZN or IEF can also be shorted here at the trendline).