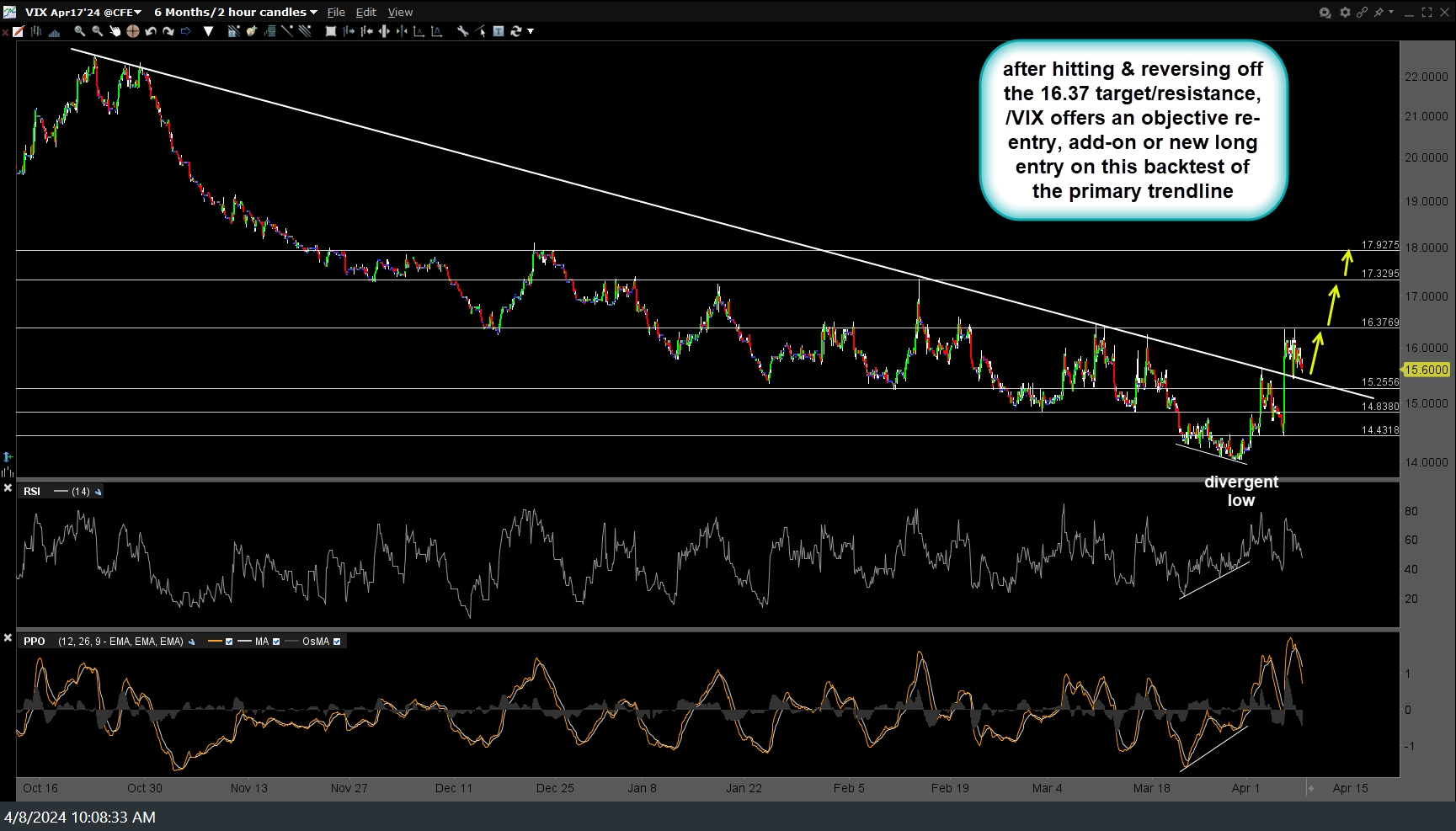

After hitting & reversing off the 16.37 target/resistance, /VIX ($VIX futures) offers an objective re-entry, add-on or new long entry on this backtest of the primary trendline on this 120-minute time frame. Note, this is the April contract (still most active) but will be rolling to the May’s soon.

One could also opt to use one of the various $VIX tracking ETFs such as VIXY or VIXM as well as ETNs (VXX, VXN, etc). One could also wait for a solid break below the key 433 support on QQQ for a higher probability entry, although the $VIX would likely be considerable higher if/when that happens.

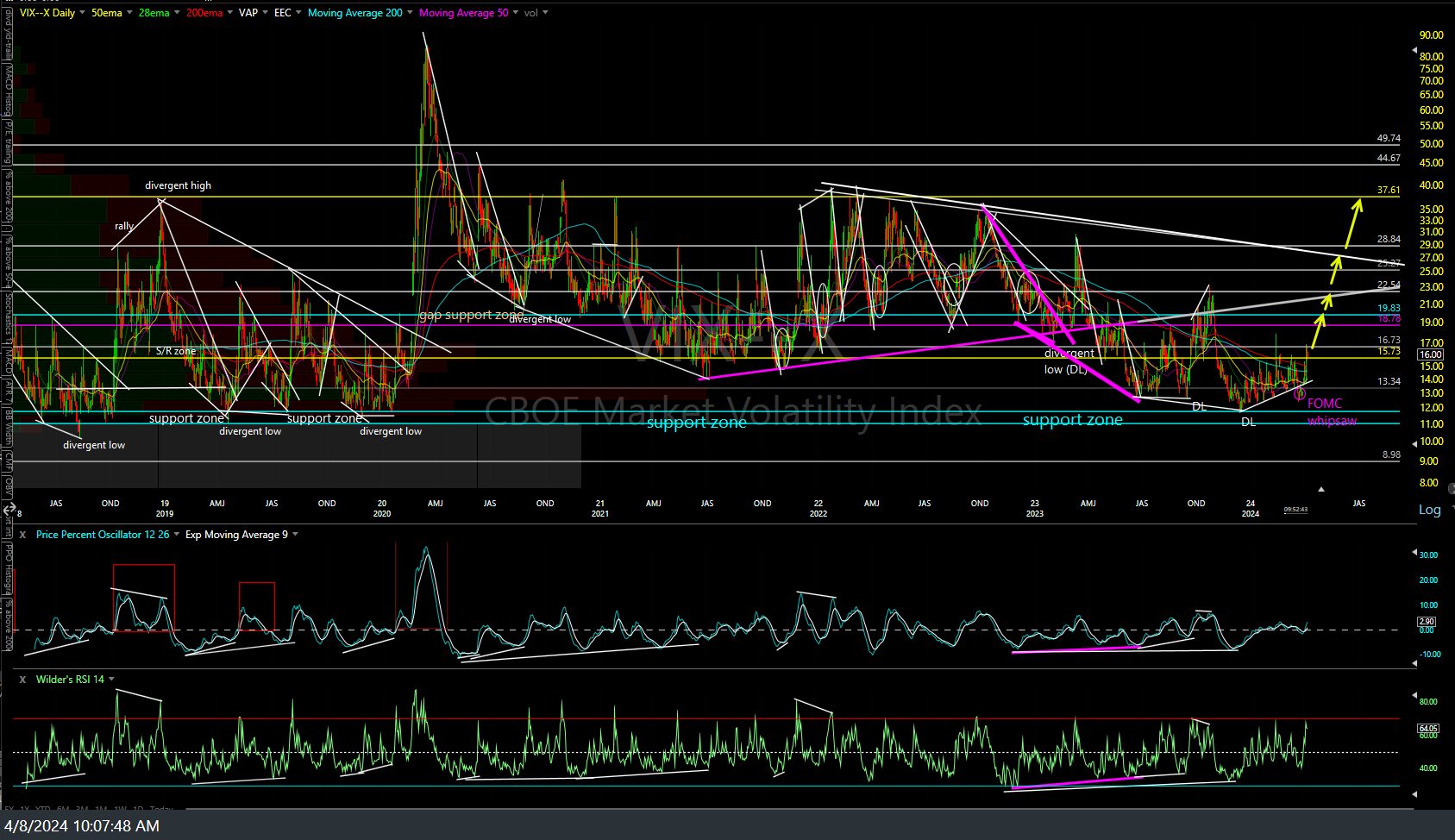

Here’s a long term daily chart of $VIX (spot VIX index) followed by a zoomed in version with rough targets on both, contingent on getting the potential sell signals I’ve been highlighting for months on QQQ as well as the majority of FKA Mag 7 stocks and top sectors of the S&P 500. No break below QQQ 433 = no major sell signal on the stock market = no significant rally for the $VIX.