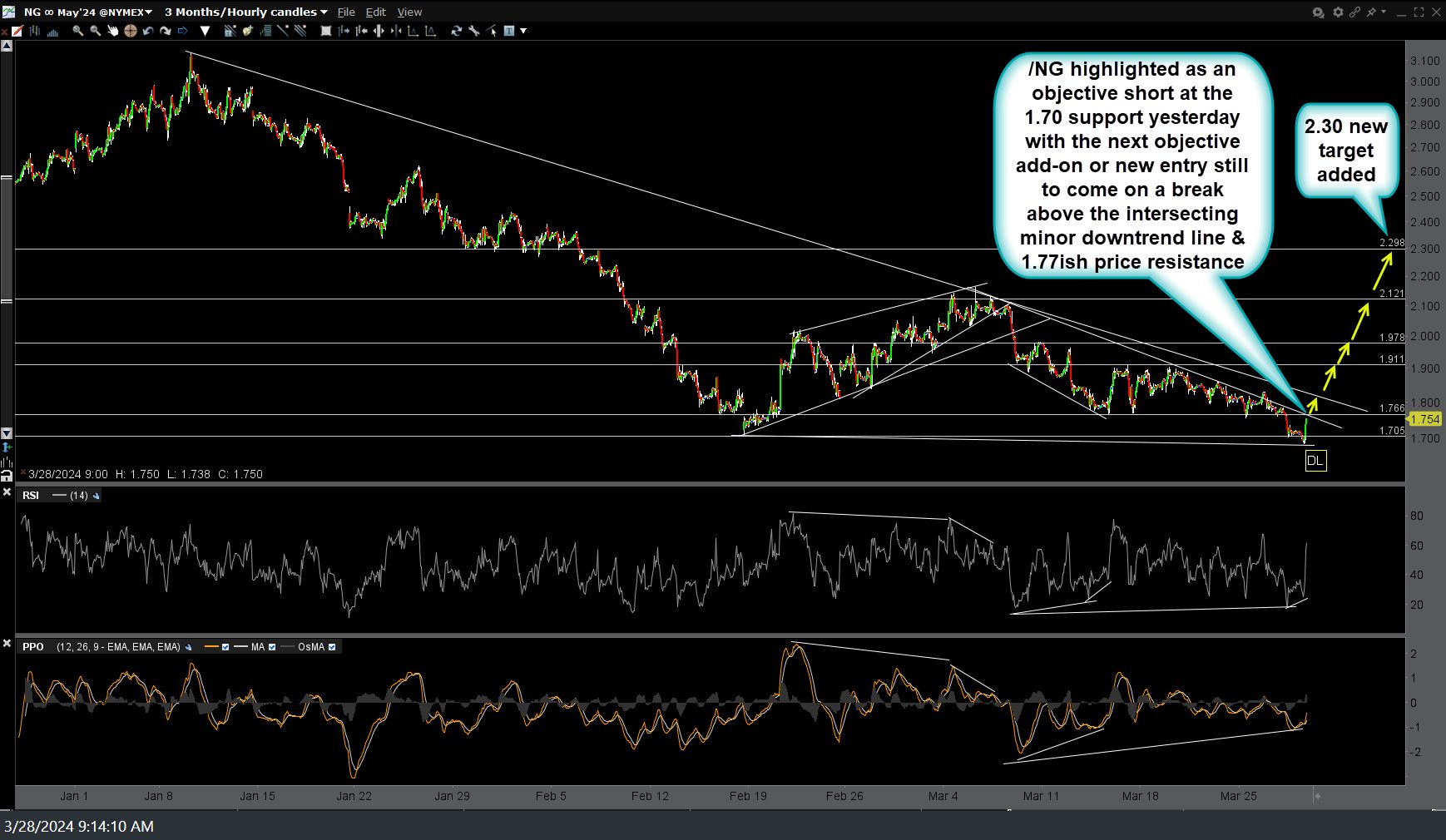

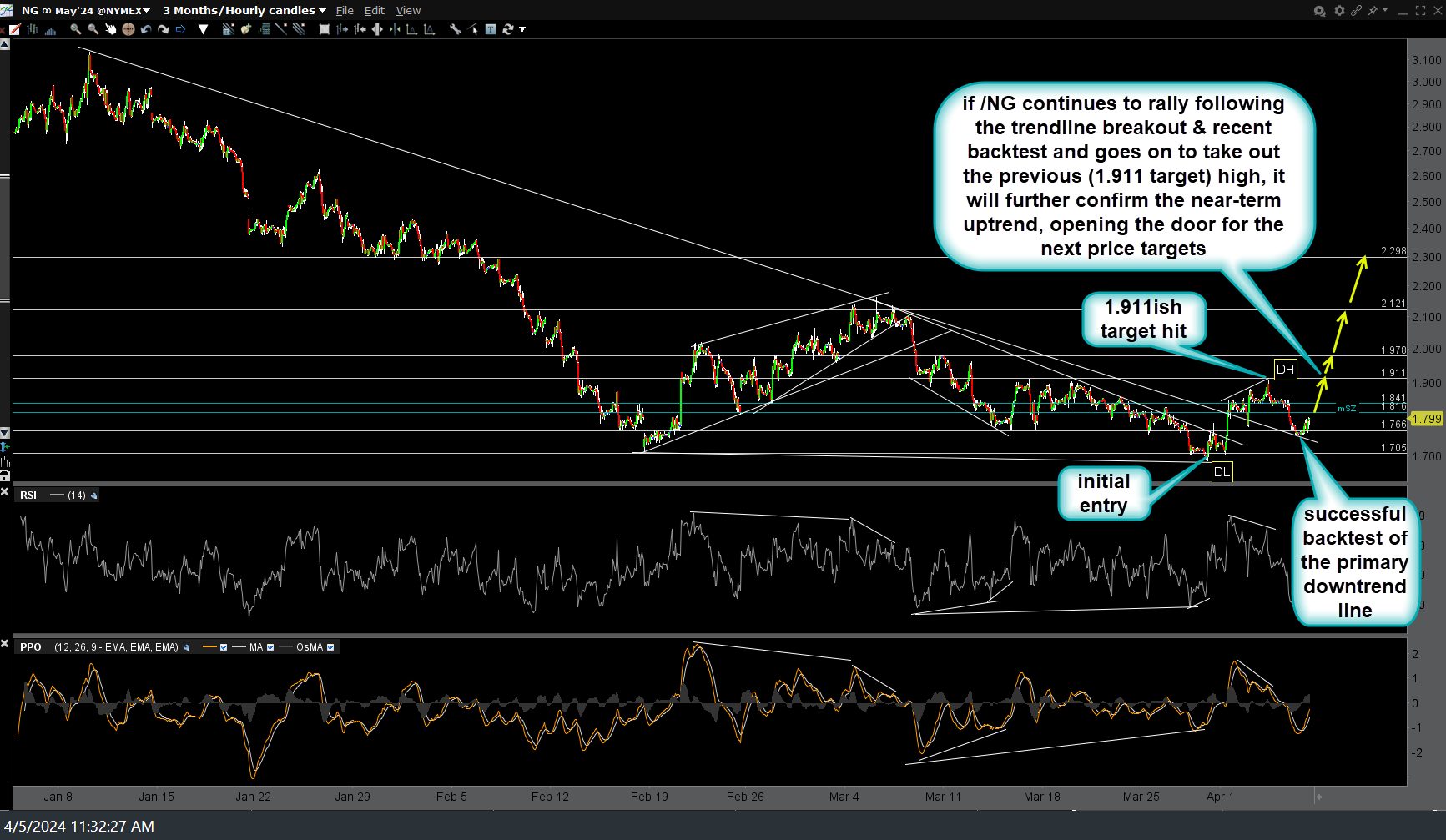

After the typical reaction off the initial tag of the 1.911ish price target, /NG (natural gas futures) pulled back to make a successful backtest of the primary uptrend line, also offering an objective add-on or re-entry for those that booked the quick profits at the 1.91ish target. If natural gas continues to rally following the trendline breakout & recent backtest and goes on to take out the previous (1.911 target) high, it will further confirm the near-term uptrend, opening the door for the next price targets. Initial 60-minute chart (posted the day after the entry was highlighted in the trades idea video) & update 60-minute charts below.

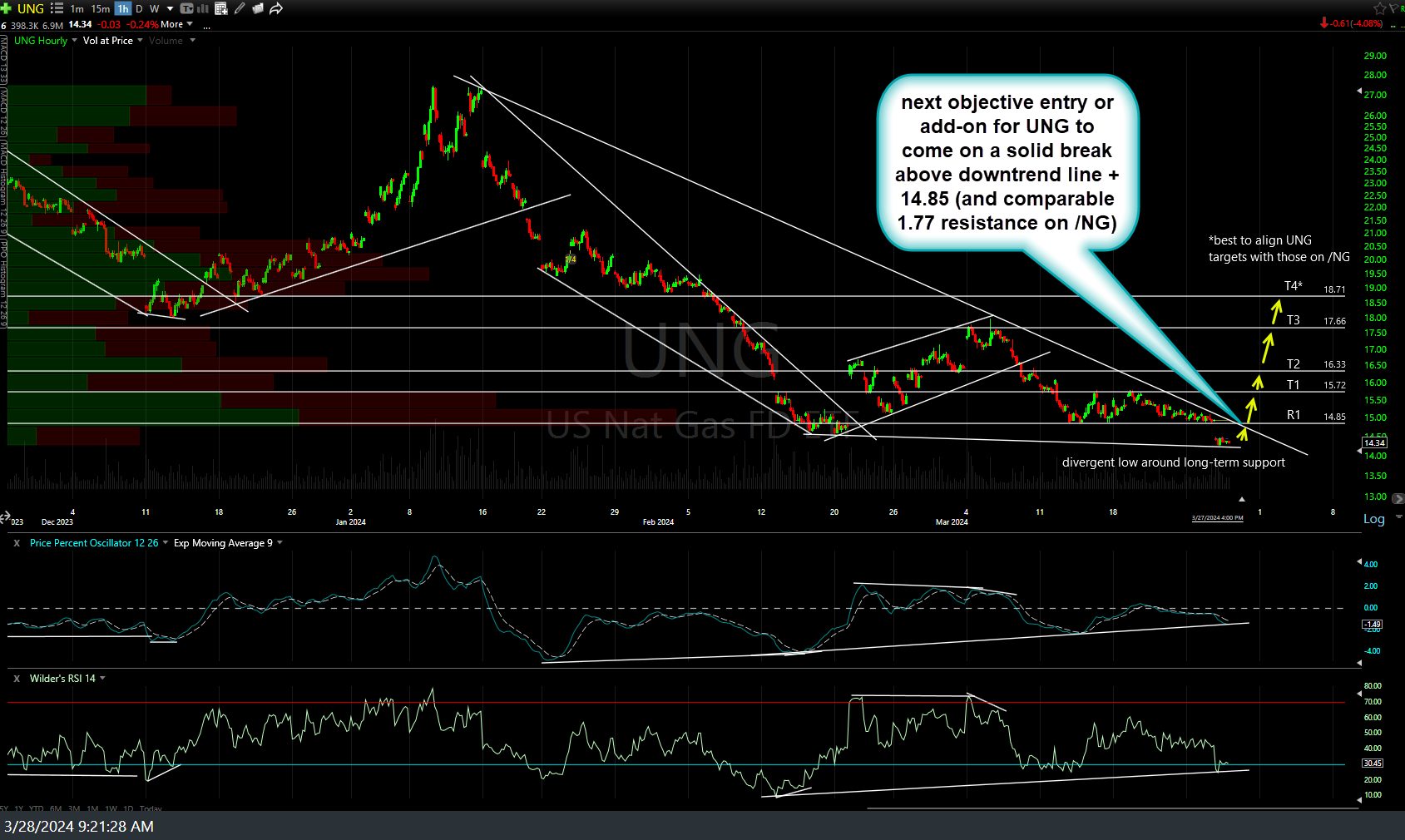

For those that prefer trading ETP’s over futures, this pullback to my former R1 (first resistance level), now S1 (support) following the hit & reversal off T1 offers an objective add-on or re-entry for those that booked profits at that first price target. Initial (March 28th) & updated 60-minute charts below.