IEF (7-10 year Treasury bond ETF) is still trading in the YELLOW ZONE, providing objective short entries on rallies into resistance on the stock market until/unless it moves back into the GREEN ZONE. 60-minute chart below.

Once again, an objective short entry is not necessarily synonymous with what I refer to as a high-probability short entry. Objective means just that & as long as SPY & QQQ remain above the primary uptrend lines off the October lows, we do not nor have not had any high-probability sell signals for a swing or trend short trade on the stock market.

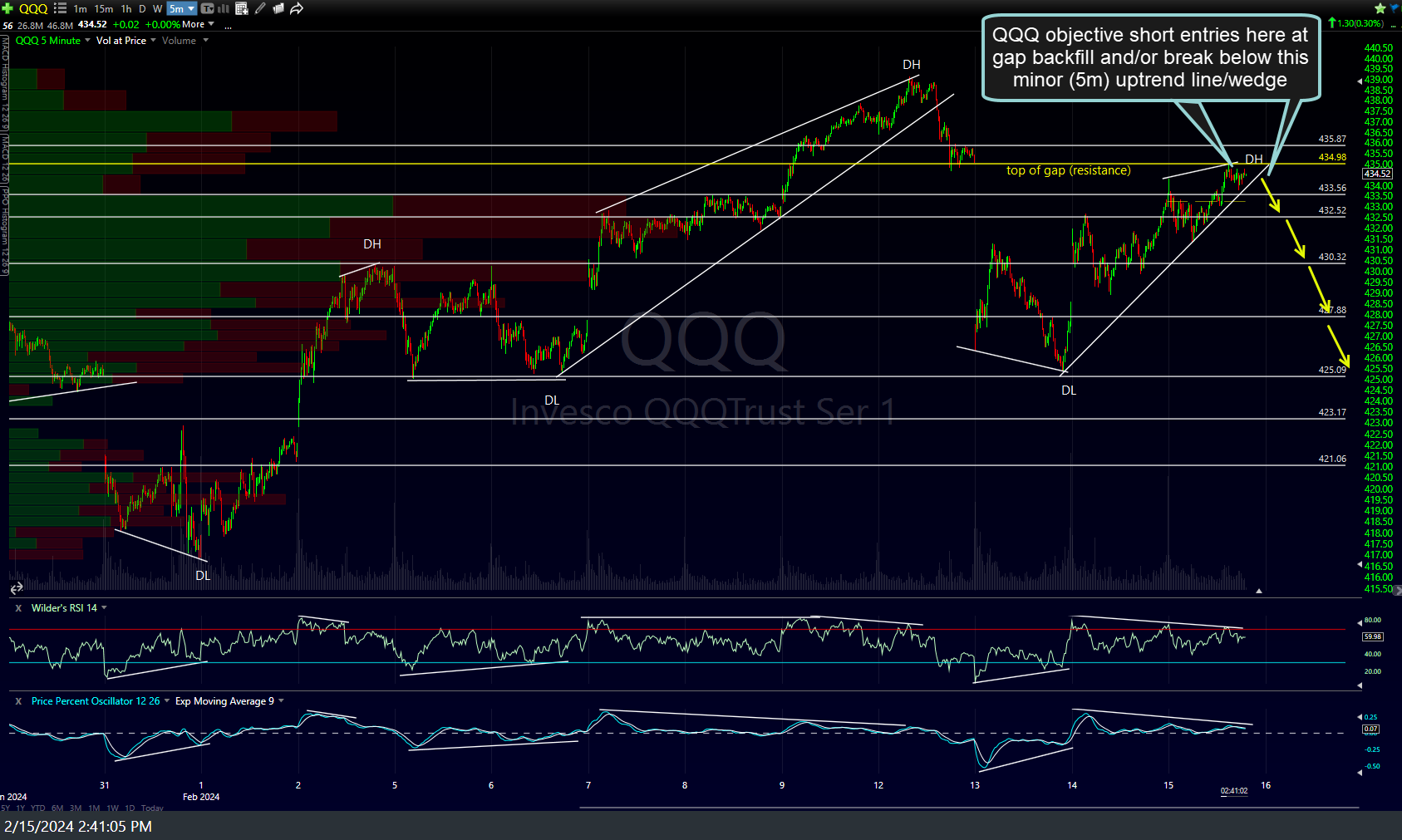

While I’m still awaiting solid breakdowns and/or daily closes above those key uptrend lines (or even better, breaks below Tuesday’s lows on SPY, QQQ, META, & AMZN), with IEF still in the YELLOW ZONE, this backfill of the recent gap on QQQ offers an objective short entry for active traders as well as aggressive swing traders scaling into a short position in anticipation of a break below the daily & 60-minute uptrend lines before taking a full position. Additional, a break below the minor uptrend line (bearish rising wedge) on the 5-minute chart of QQQ below will also offer an objective short entry or add-on to a starter short taken here at the top of the gap. Arrow breaks denote potential near-term pullback targets. Stops should be commensurate with one’s preferred price target(s) relative to their average entry price.