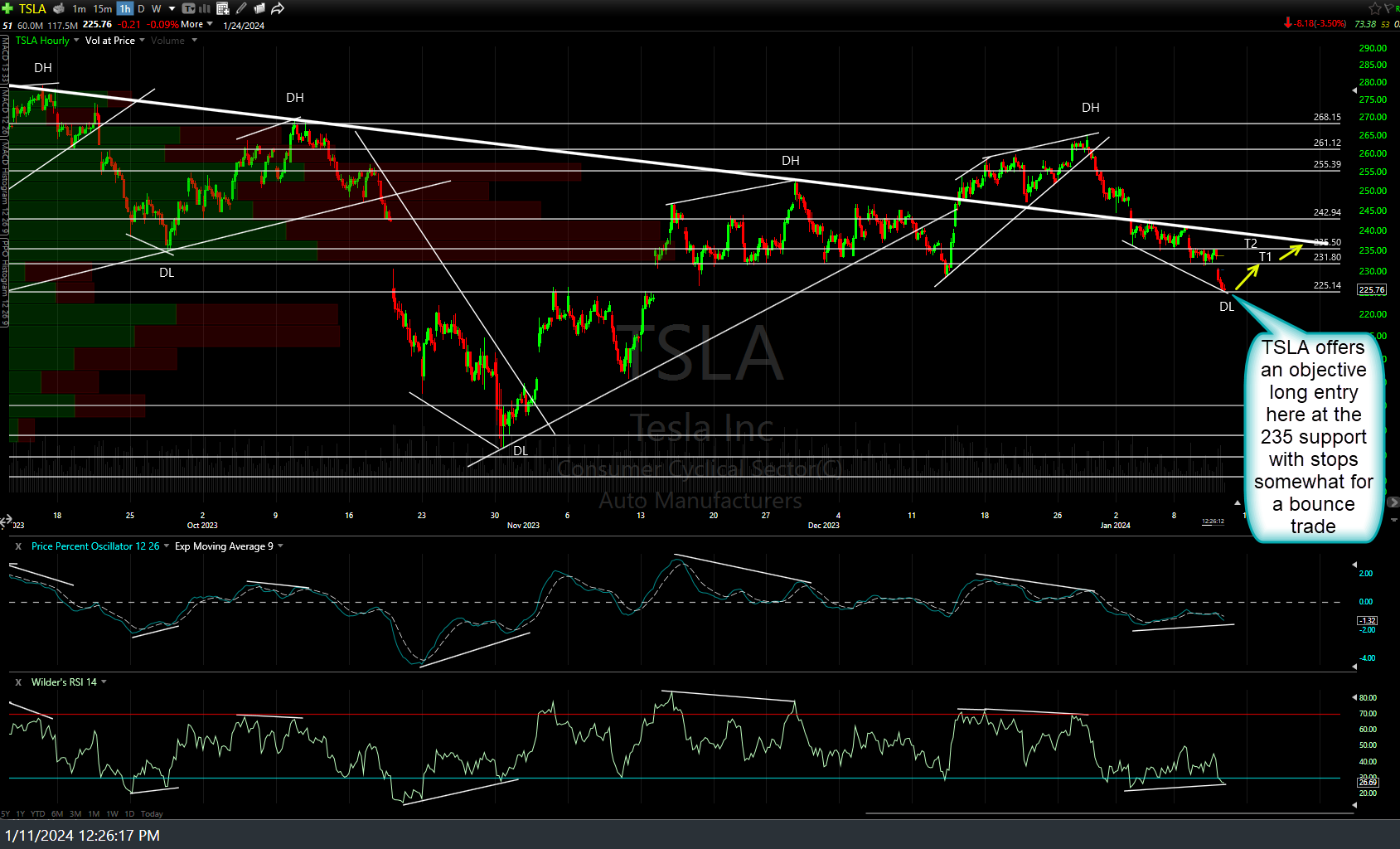

The TSLA bounce trade posted yesterday has exceeded any reasonable stop (based on an R/R perspective if targeting T1 or T2). Additionally, the reasons for the long (falling to 225 support with positive divergences) have both been invalidated (well below 225 now & the positive divergences have been ‘negated’ or burned thru/taken out with lower lows in the PPO & RSI). Previous & updated 60-minute charts below.

My reply to a couple of questions in the comment section, including what I think would be the best option at this time, if still long (a stop below today’s low):