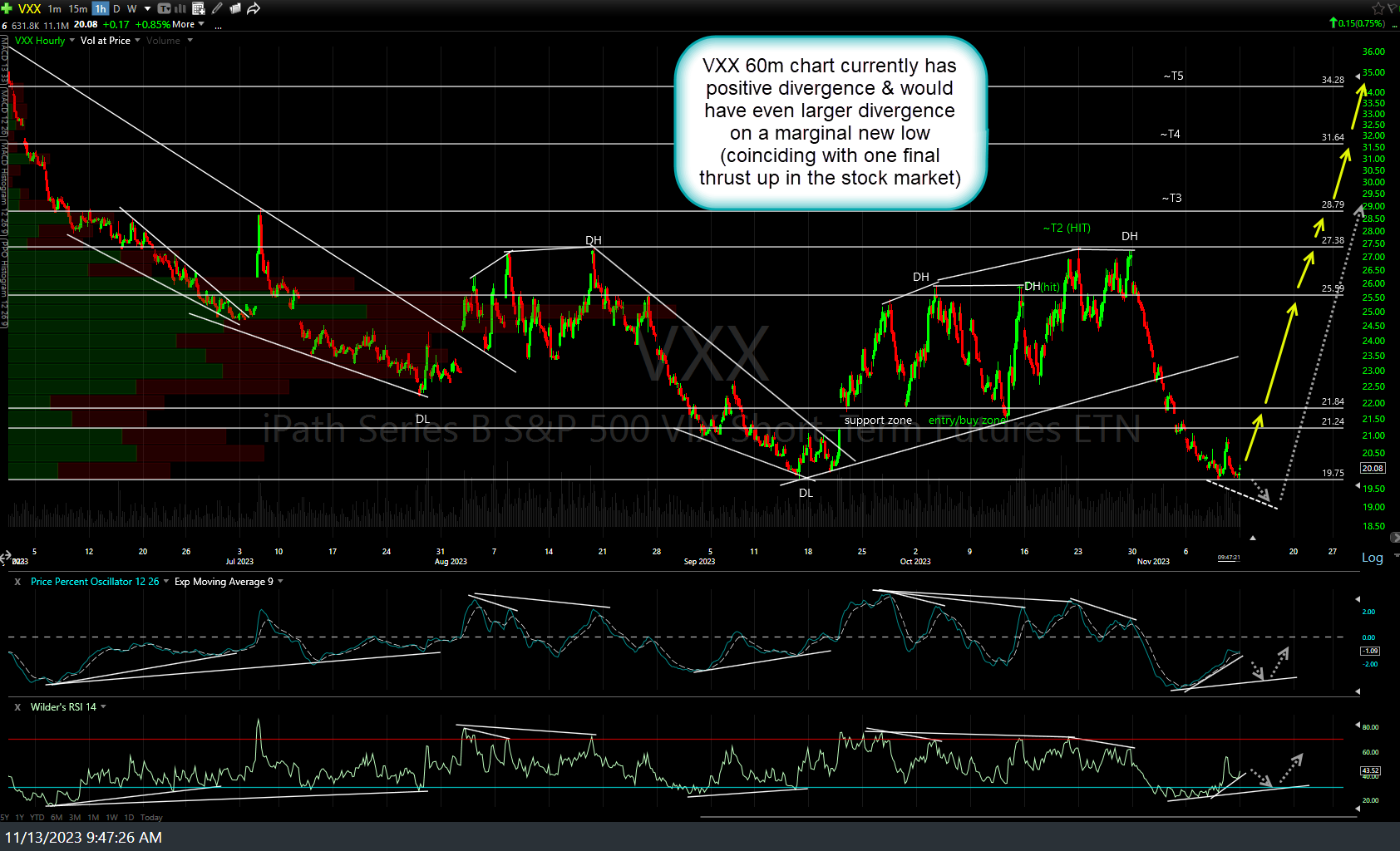

VXX (VIX short-term futures ETN) 60-minute chart currently has positive divergence & would have even larger divergence on a marginal new low (coinciding with one final thrust up in the stock market). Therefore, in conjunction with the case made for an objective short entry on the Nasdaq 100 earlier today, VXX (or /VIX futures) offers an objective long entry here with either a relatively tight stop or a wider stop (and/or scale in strategy) for those leaning towards one more thrust up in the stock market. (My preference is the former vs. the latter). 60-minute charts of VXX & /VIX ($VIX December futures contract) below.

As always, one should consider applying the proper downward beta-adjustment to their position size when trading any of the $VIX tracking instruments due to the extreme volatility and above-average gain/loss potential & as always, pass if this type of trade does not mesh with your risk-tolerance, trading style, and/or outlook for the stock market.