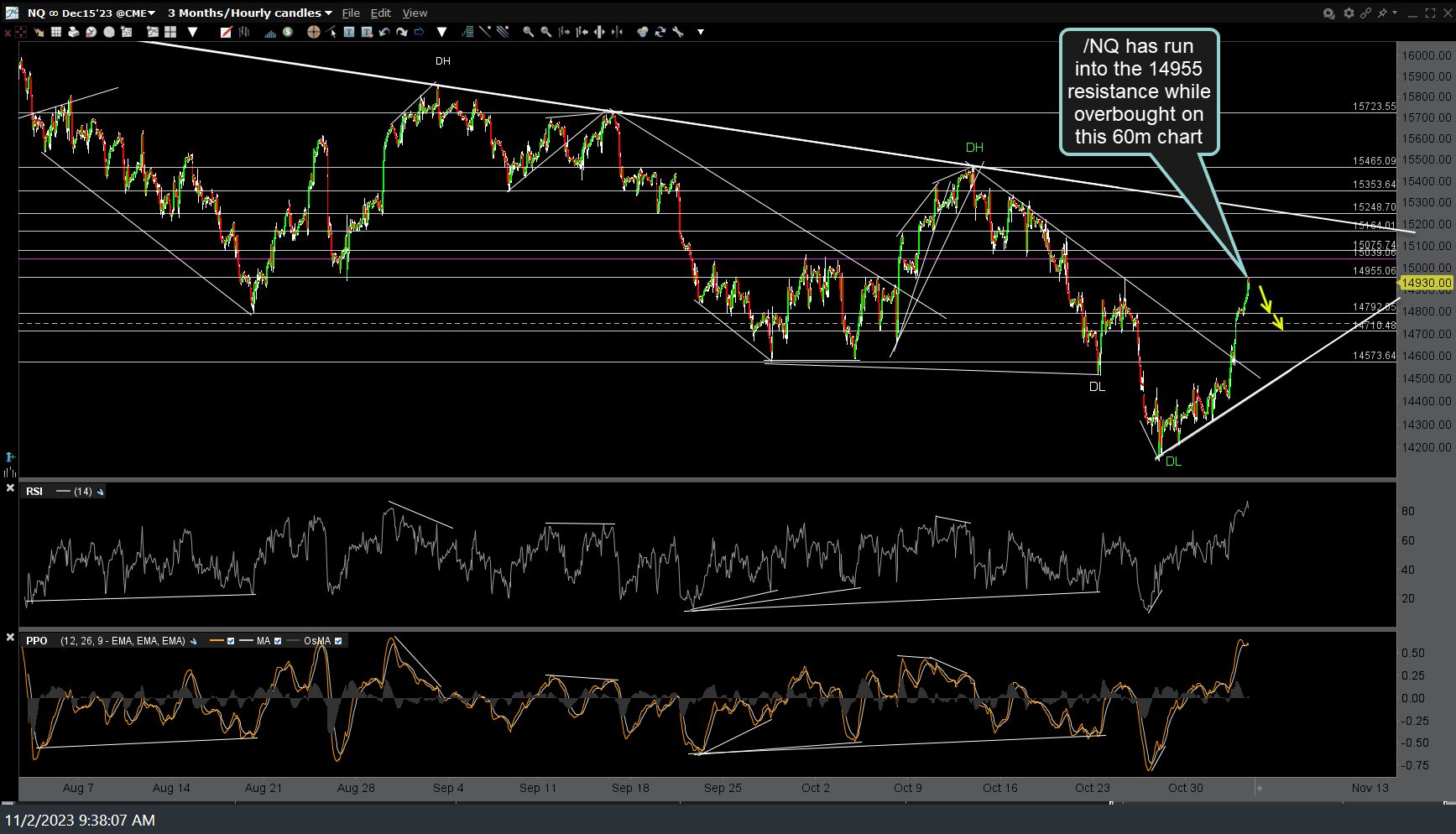

With the FOMC meeting now out of the way, the market now awaits the potential (and likely) market-moving earnings report from the leader of the Magnificent 7 tonight, AAPL (Apple Inc). As I stated in recent videos, I suspected the stock market would likely drift higher into & after yesterday’s FOMC “no change” rate decision and into today with profit taking kicking in before the close today in advance of AAPL’s earnings report after the close. As such, I think this is a very likely reversal point for at least a pullback trade and even an objective level to add or start scaling back into swing short positions for what could be the next leg down. Still open to the potential for more upside to the primary downtrend line which capped the previous counter-trend rally although AAPL earnings will either make or break that scenario. 15 & 60-minute charts of /NQ & QQQ below.

/NQ & QQQ Charts Nov 2nd

Share this! (member restricted content requires registration)

1 Comment