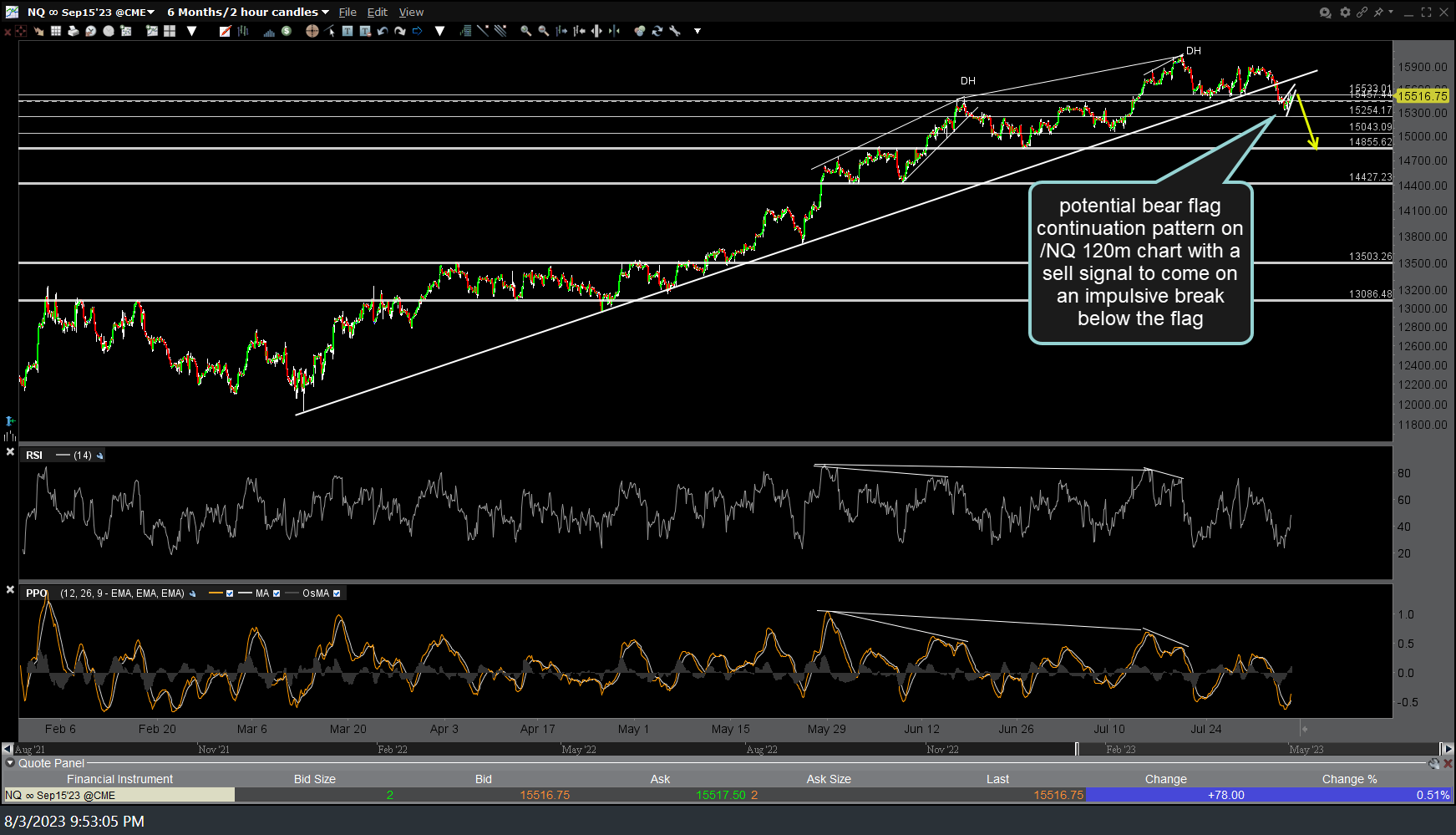

Really not much to add to yesterday’s final post other than the fact that /NQ (Nasdaq 100 futures) drifted a hair lower to effectively hit* & reversed off my initial primary swing target in the late-evening trading session. It still appears to me that a tradable rally in the coming sessions is likely & at minimum, the R/R for active traders staying short or adding to new shorts is not very attractive IMO, especially if SPY & QQQ make solid recoveries & closes back above their respective 50-day EMAs. August 3rd & today’s updated 120-minute charts below.

*As I often state, the price targets shown on my charts are the actual support level where a reaction is likely upon the initial tag. On short trades, it is best to set your buy-to-cover order slightly above the support level(s) you are targeting as buyers will often step in early to a well-watched support level. Vice versa for long trades (sell slightly below the actual resistance level you are targeting).