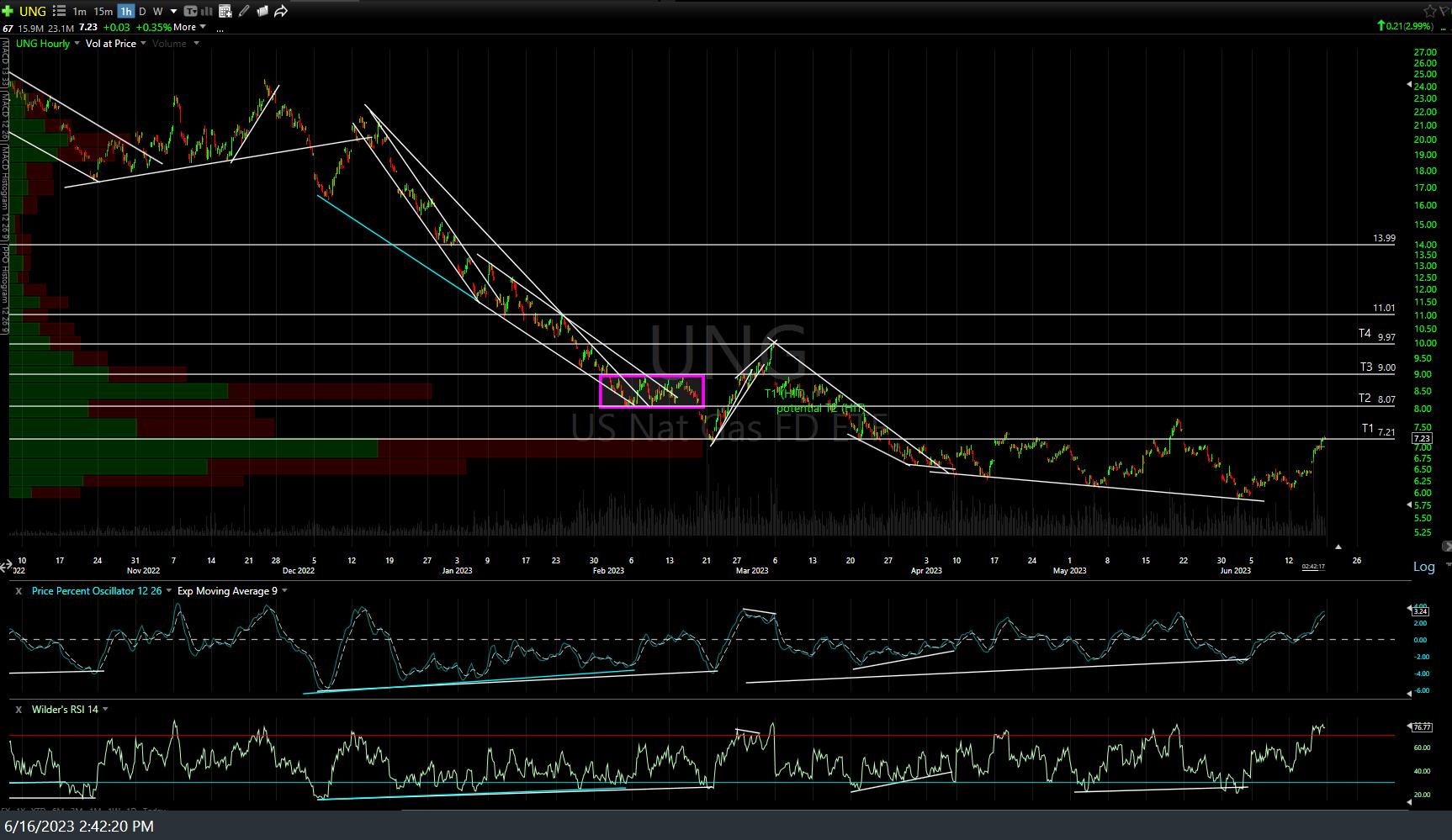

UNG (natural gas ETN) is currently trading at T2 (second price target & resistance) on the 60-minute chart which increased the odds for a reaction. As such, consider booking partial or full profits and/or raising stops to protect gains if holding out for any of the additional targets. The previous (June 16th) chart which was posted when T1 was first hit following the June 1st divergent low (although UNG was covered many times since in videos) followed by the updated 60-minute chart, showing today’s pre-market trades in white, below.

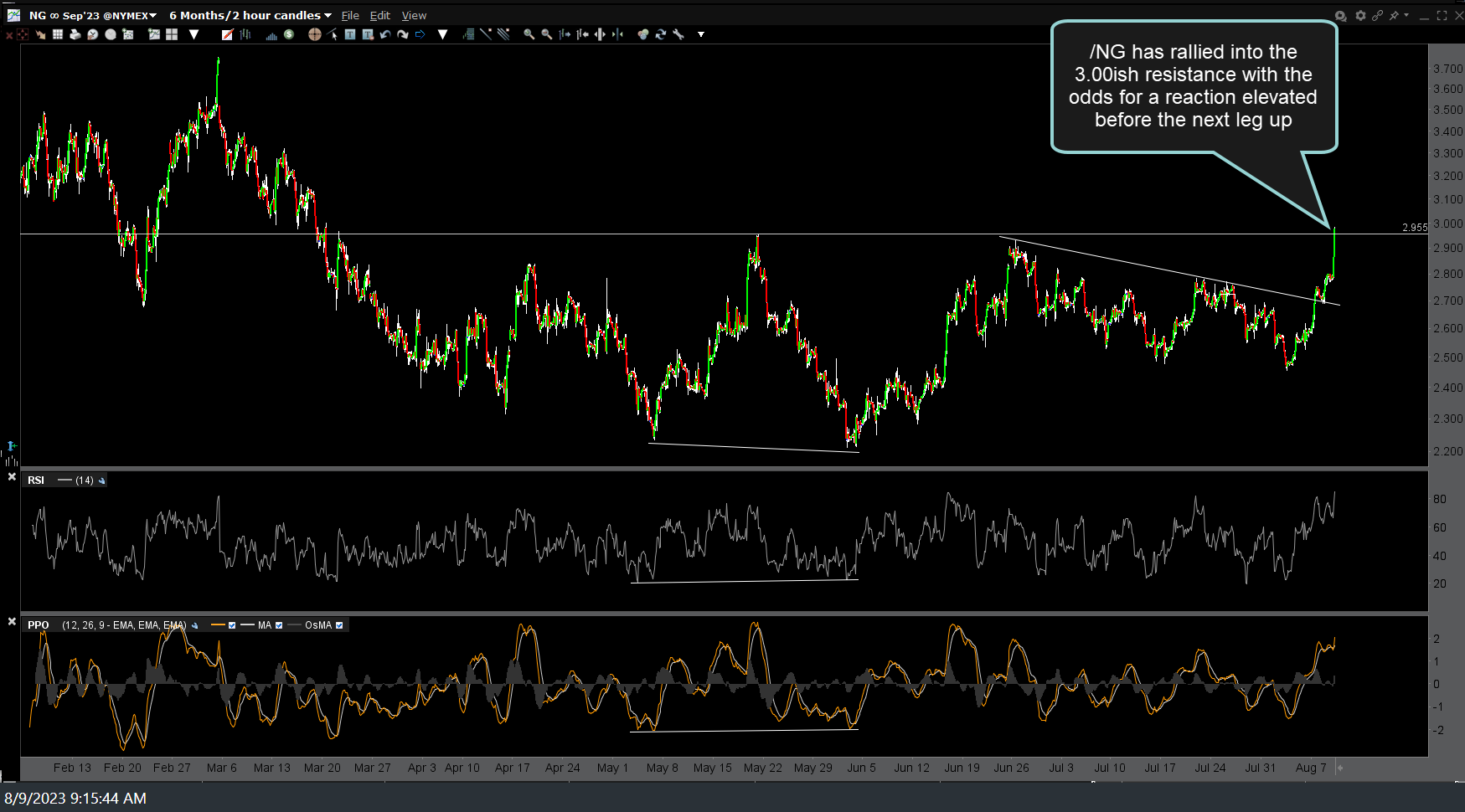

Likewise, /NG (natural gas futures, Sept contract) has rallied into the 3.00ish resistance with the odds for a reaction elevated before the next leg up. 120-minute chart below.

My preference, as when natural gas wants to run it can really run, is to raised stops to a fairly tight level & give it the opportunity to run or at least give back minimal gains, should it pullback off the current resistance level(s) & trigger the stop.