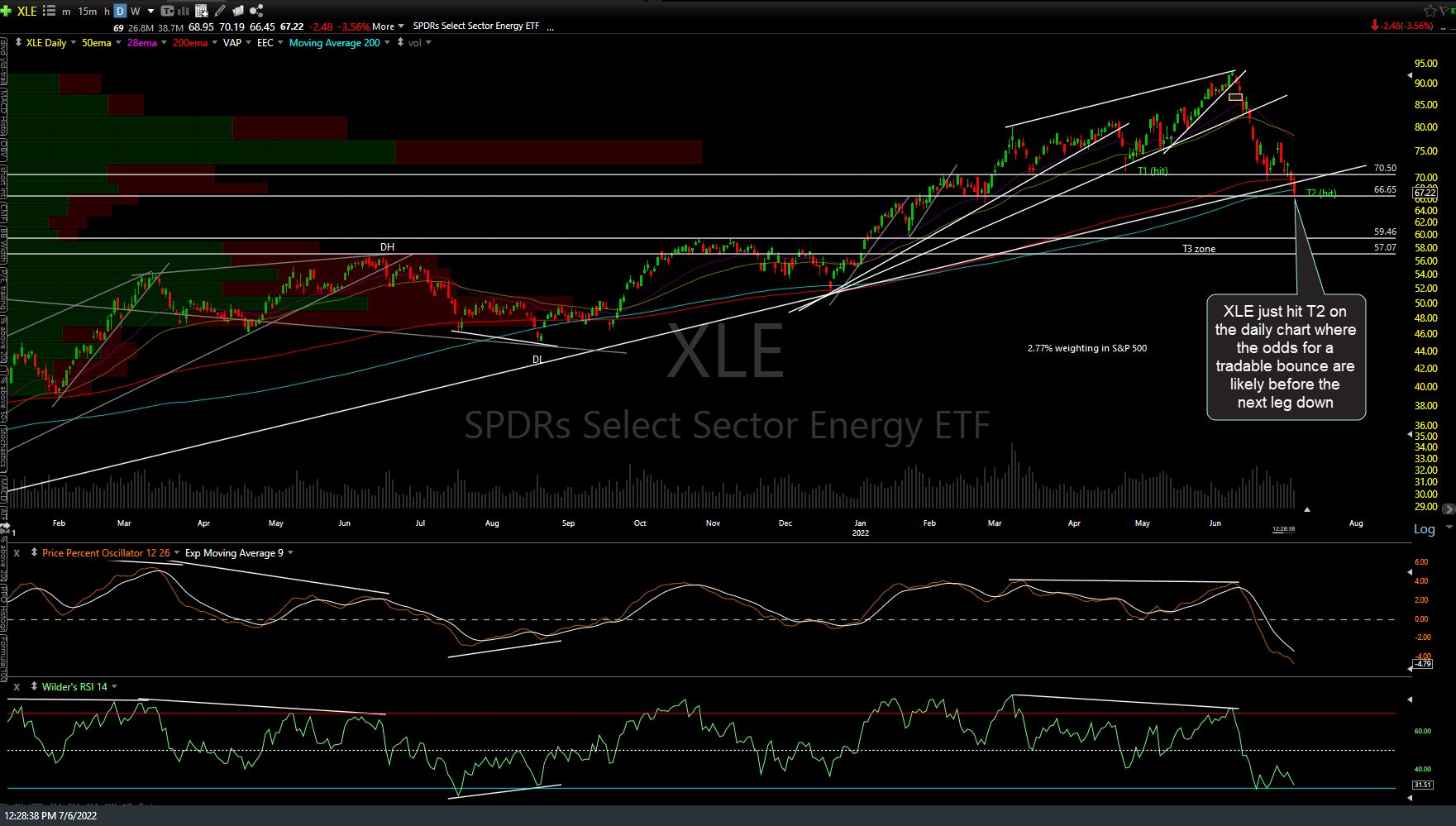

XLE (energy sector ETF) just hit T2 on the daily chart where the odds for a tradable bounce are likely before the next leg down.

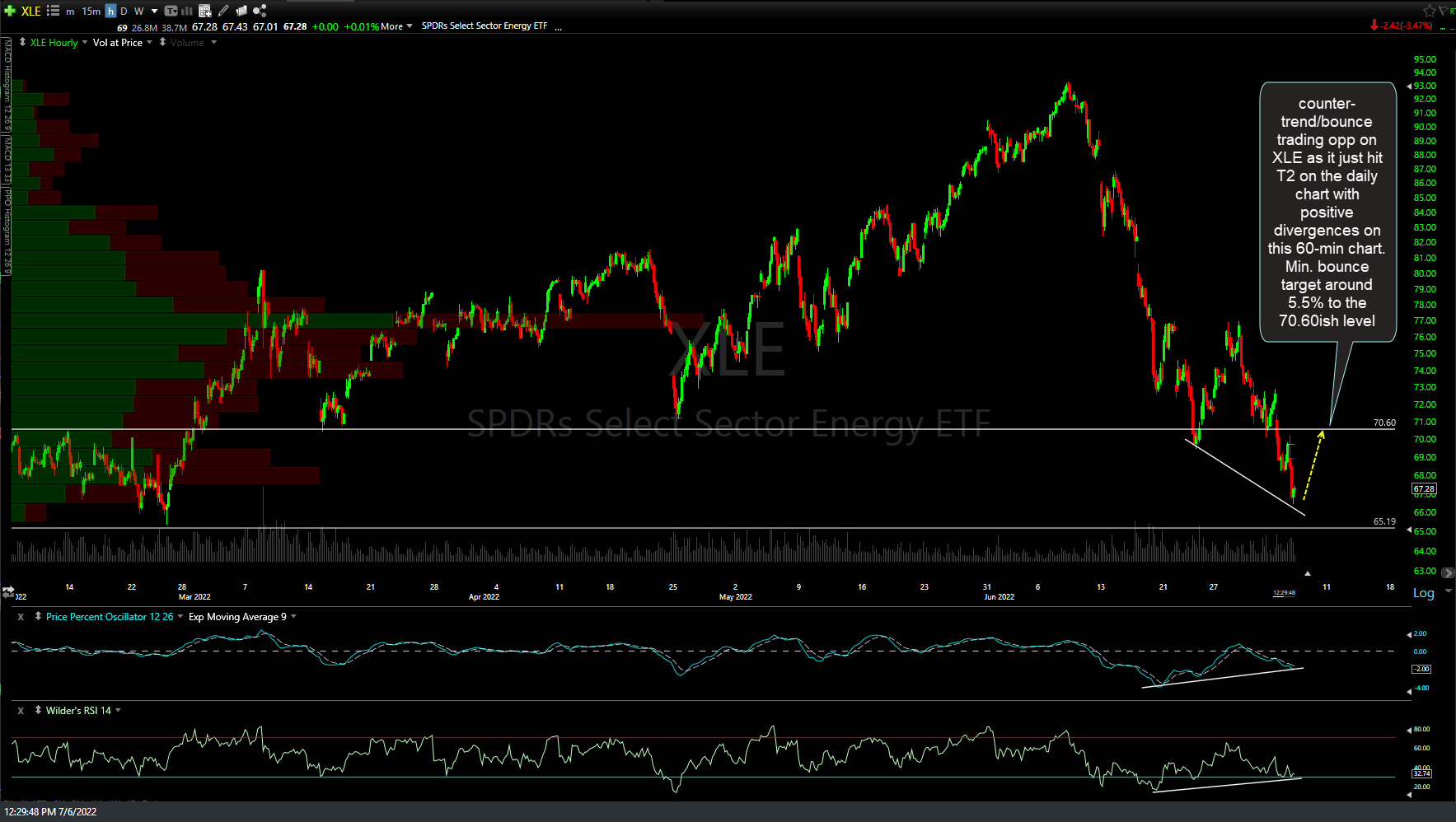

Zooming down to the 60-minute time frame, one could make a decent case for a counter-trend/bounce trading opp on XLE as it just hit T2 on the daily chart with positive divergences on this 60-min chart. Min. bounce target around 5.5% to the 70.60ish level.

On a related note, /CL (crude oil futures) just hit & reversed off the 95.29 minor support level with positive divergences forming (but not yet confirmed) on the 60-minute chart.

Of course, taking any positions in front of the release of the FOMC Minutes at 2 pm EST today is somewhat of a wildcard but passing along the trade idea for those interested in trying to game a counter-trend bounce in crude, including USO, UCO, XLE, XES, XOP, etc.. (crude ETNs and oil & gas sector ETFs).