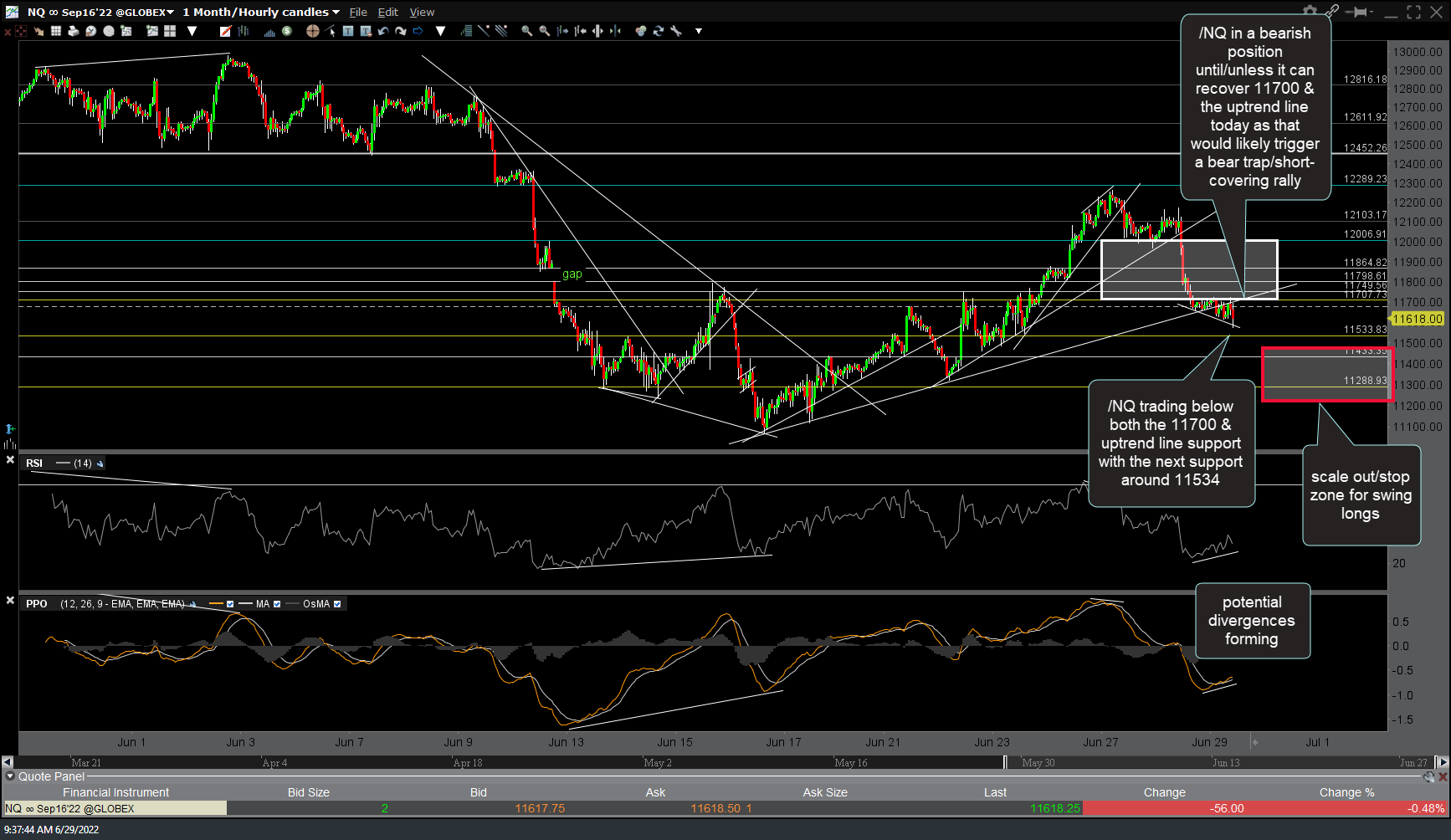

/NQ (Nasdaq 100 futures) is currently trading below both the 11700 & uptrend line support with the next support around 11534. This puts the Nasdaq in a bearish position until/unless it can recover 11700 & the uptrend line today as that would likely trigger a bear trap/short-covering rally.

With positive divergences forming the 60-minute chart coupled with the much larger positive (bullish) divergence still intact on the more significant daily time frame (including the fact the near-term uptrend is still well-intact), I’d say the odds are above-average (60%+) that we could see a recovery of the 11700 level soon. I’ve also included my stop (scale-out) zone for my current swing long position in /NQ, should the 11530ish & 11290ish support levels fail to hold.

A couple of options on how to trade this: For those near-to-intermediate-term bullish, at this time, best to wait for a solid recovery back above 11710 & the uptrend line before initiating or adding to an existing long position. Those bearish & looking for a resumption of the downtrend with a drop down to my (or your) next downside trend targets, could initiate or add to a short position here with stops somewhat above the 11710 former support, now resistance level & uptrend line just above it while continuing to add to a short position if/as the 115300ish & 11290ish support levels are clearly taken out.