/ZF (or IEI, 5-yr T-note ETF) offers an objective long entry on this backtest of the downtrend line on the 120-minute chart.

/ZN (or IEF, 10 yr Treasury) offers an objective long entry on this backtest of the downtrend line on the 120-minute chart.

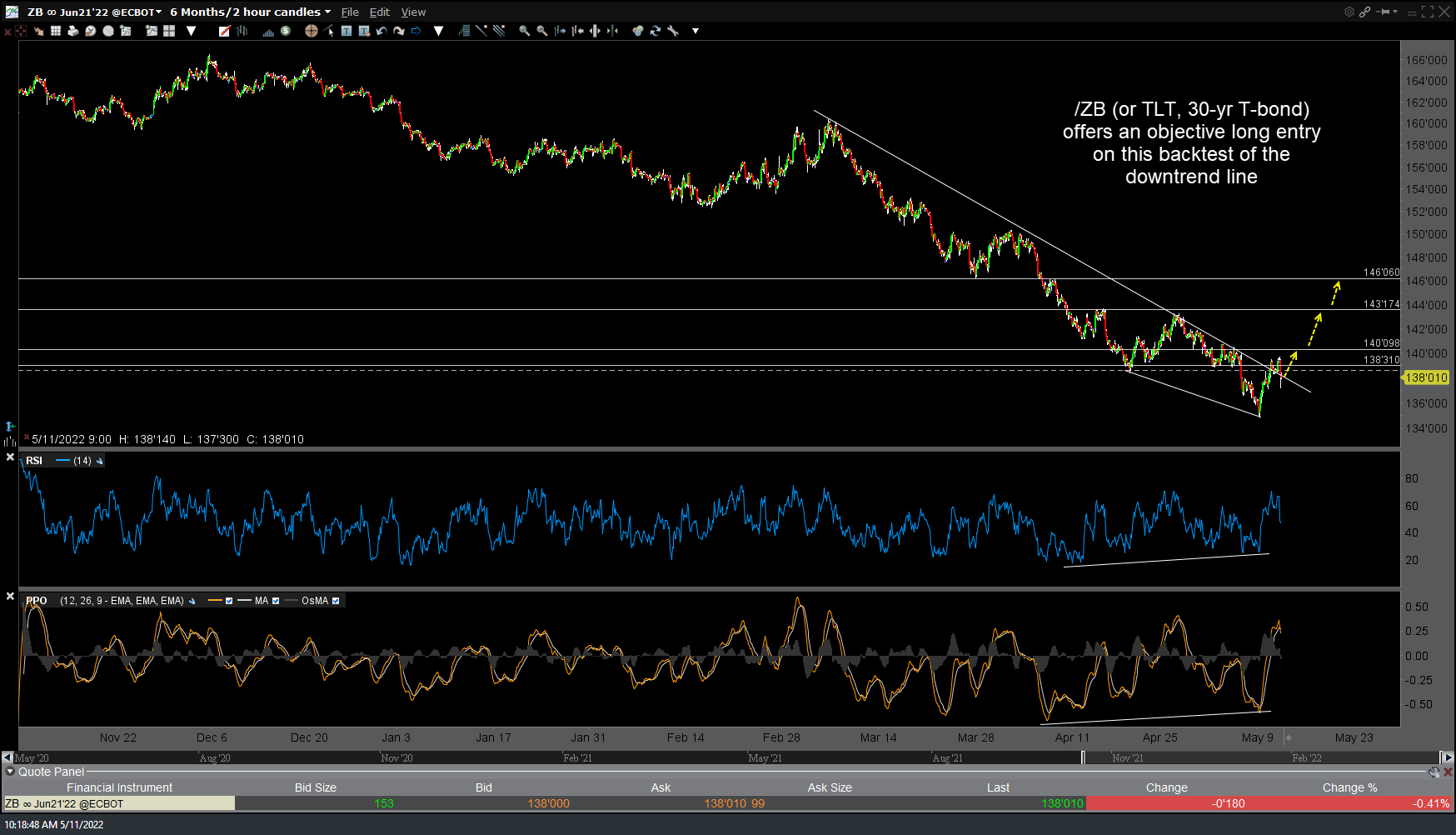

/ZB (or TLT, 30-yr T-bond) offers an objective long entry on this backtest of the downtrend line on the 120-minute chart. Basically, the longer the maturity of the bond, the higher the duration, i.e.- how much the price of the bond will move in response to a change in interest rates. As such, the price of the 10 & 30-yr bond tends to rise or fall more or less than the 5-yr note.

Also, while US Treasuries & the stock market have been largely moving in tandem recently, typically Treasury bonds will rally during periods of stock market volatility & corrections although the Fed has thrown a major monkey wrench into the financial markets, particularly the bond market, so we’ve seen that historical inverse correlation between stocks & bonds more off than on lately although I do still like the near-to-intermediate-term outlook for Treasury bonds based on the charts as well as part of a diversified portfolio. I still remain longer-term bearish on Treasuries.