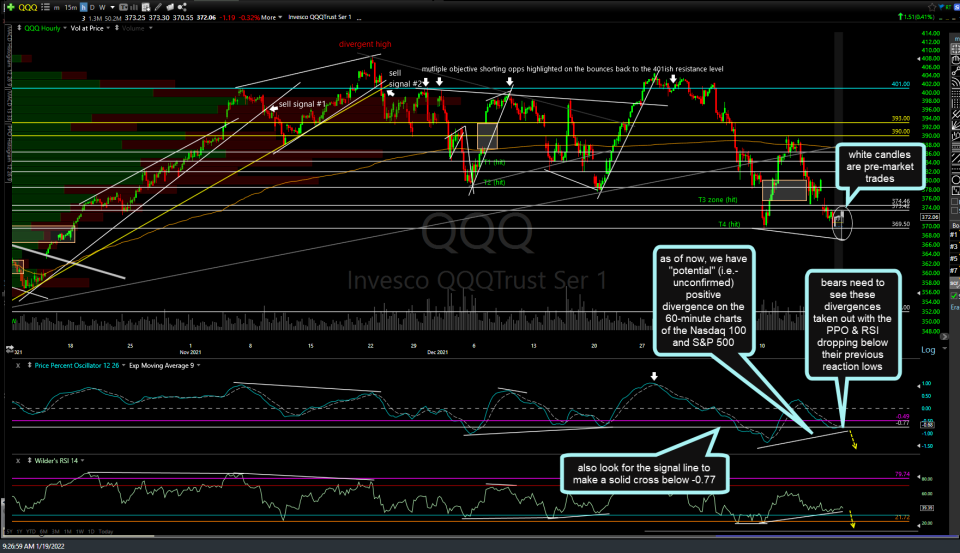

As of now, we have “potential” (i.e.- unconfirmed) positive divergence on the 60-minute charts of the Nasdaq 100 and S&P 500. In addition to a solid break below Monday’s lows (during the regular trading session), the bears need to see these divergences taken out with the PPO & RSI dropping below their previous reaction lows as well as a solid cross of the PPO signal line (9-ema) below the -0.77 level on the PPO as that level helps to define bullish & bearish trends on the 60-minute time frames.

With the major stock indices still holding above Monday’s lows & potential bullish divergence on the 60-minute time frames, one could make a case to go long here with a stop set based on the aforementioned criteria.