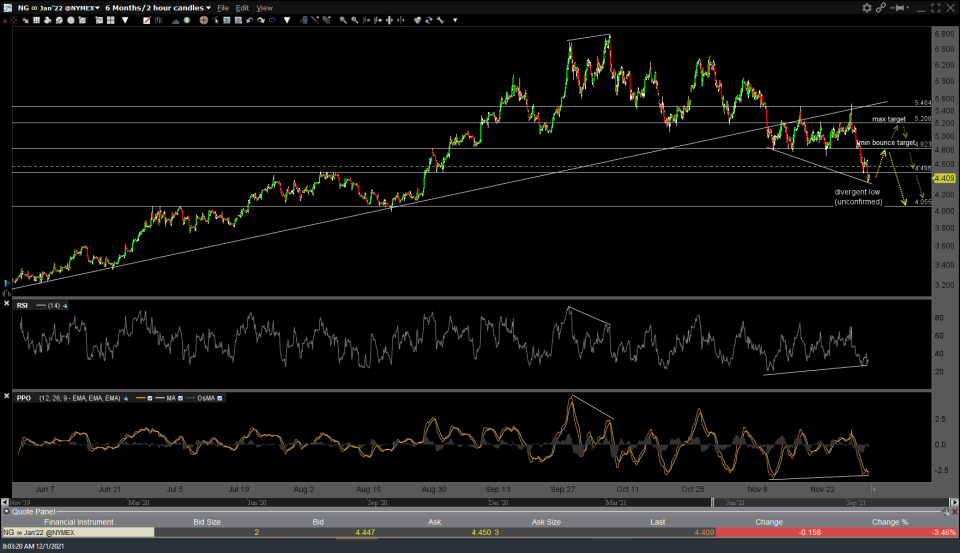

Both natural gas & crude oil were mentioned as bounce trade ideas yesterday, reversing from a short position to a long position for a bounce trade as both were trading near support with potential bullish divergences forming between prices & the momentum indicators. So far, crude has rallied about 8% off yesterday’s divergent low while natural gas is still hovering around the 4.48ish support. Two potential bounce targets (minimum & maximum) are listed for both on the 60-minute chart of /CL (crude) and 120-minute chart of /NG (nat gas) below.

Note: Crude oil is currently trading at the minimum target (23.6% Fibonacci retracement level) so active traders might opt to either book profits here and/or raise stops if holding out for more upside.