With my expectation for a major top in crude still very much intact coupled with the recent sell signals & divergent high, any counter-trend rallies into resistance could be viewed as objective shorting opportunities or add-on to a swing/trend short position. 120-minute chart below.

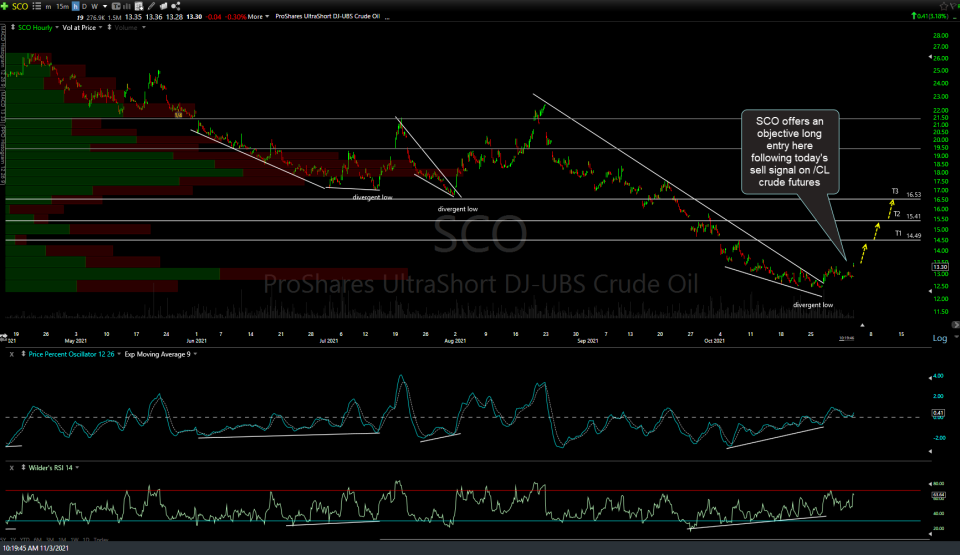

My third & final “near-term” target, T3, was *effectively hit for a quick 23-32% profit (*T3 was an unadjusted target with the suggested sell limit to be set slightly below the actual resistance level, which is where SCO reversed). The previous 60-minute chart posted back on Nov 3rd followed by the updated 60-minute chart below.