Although /ZW (wheat futures) didn’t reverse off the pullback to the 675 support yesterday, it once again offers an objective long entry on the backtest of this bullish falling wedge with stops somewhat below for a swing trade up to the 2nd target around 717 (as T1, 675, was already hit).

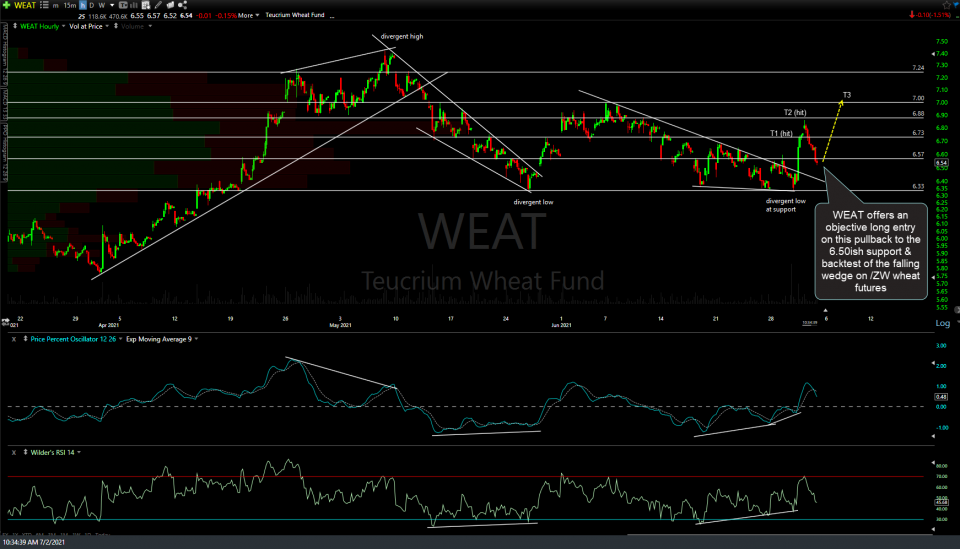

Likewise, WEAT (wheat ETN) offers an objective long entry on this pullback to the 6.50ish support & backtest of the falling wedge on /ZW wheat futures for a swing trade up to the third price target, as T1 & T2 were already hit on the initial rally following the breakout above the bullish falling wedge pattern.