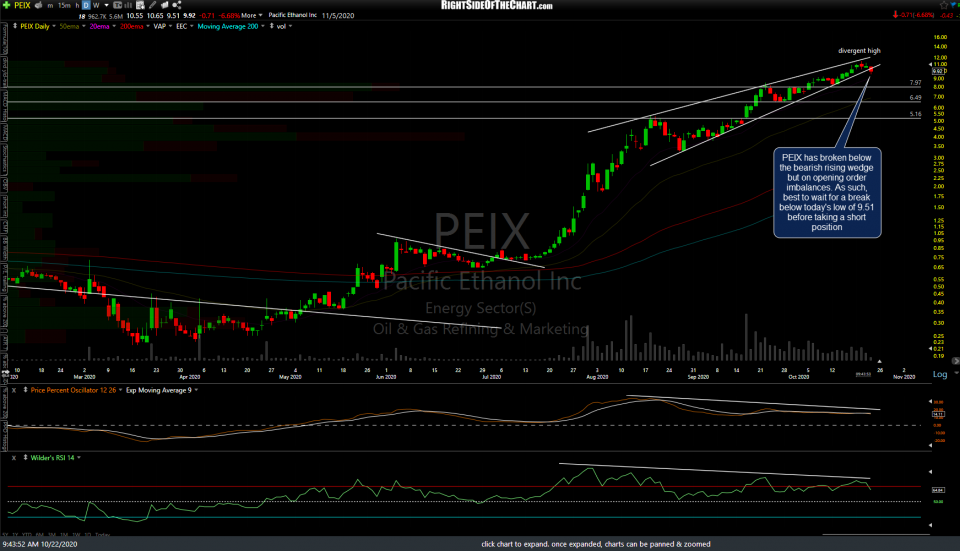

The PEIX short trade setup which was highlighted in the Oct 13th & 15th videos has broken below the bearish rising wedge but on opening order imbalances. As such, best to wait for a break below today’s low of 9.51 before taking a short position as this may prove to be an intraday dip below the trendline with the stock closing back on or above if this dip is bought up.

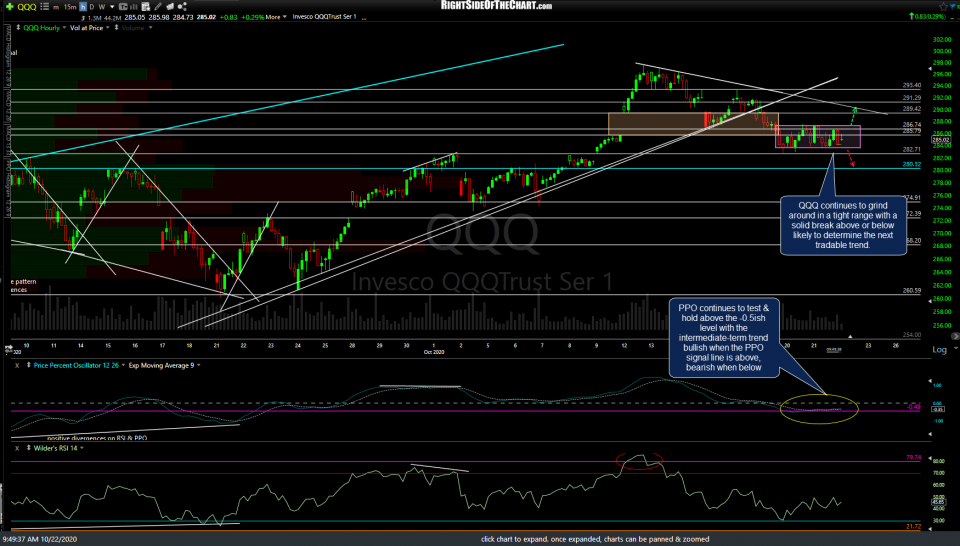

QQQ continues to grind around in a tight range with a solid break above or below likely to determine the next tradable trend on this 60-minute chart. The bullish divergences on the 60-minute chart of /NQ, until & unless negated soon, would favor the bullish scenario although whipsaws have been common lately & will likely continue to be heading into the elections. As such, swing traders might opt to wait & see how this range is resolved before doing much (or keep things light until after the elections) while active traders can continue to trade the rips & dips within the range.

/NQ continues to bounce from top to bottom of this trading range while the positive (bullish) divergences continue to build for now.