The charts of the grain ETNs; wheat, corn, & soybeans, continue to firm up. We have a bullish engulfing candlestick on WEAT (wheat ETN) today which is all but guaranteed to be finalized as such (since wheat futures will stop trading for the day soon before the stock market, WEAT ETN stops trading). Note the previous bullish engulfing candles that came around the bottom of the previous downtrends which were followed by profitable swing trades over the past year or so on the daily chart below.

/ZW (wheat futures) continues to move higher following the recent divergent low with some potential near-term targets at these arrow breaks (likely reaction points). 60-minute chart below.

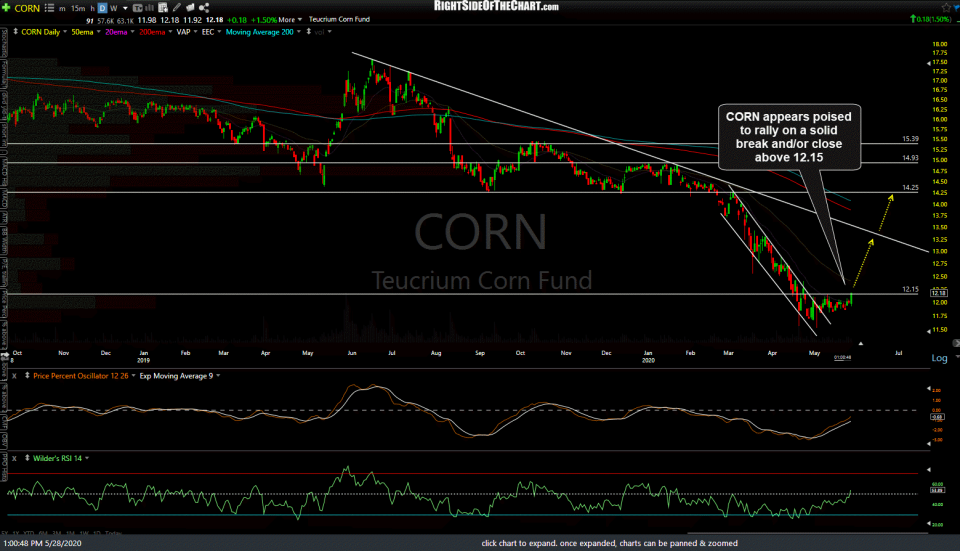

CORN (corn ETN) appears poised to rally on a solid break and/or close above 12.15. Daily chart below.

/ZC (corn futures) continues to walk up this ascending price channel with a solid break above 330 likely to spark a more impulsive rally to any or all of these marked targets on this 60-minute chart.

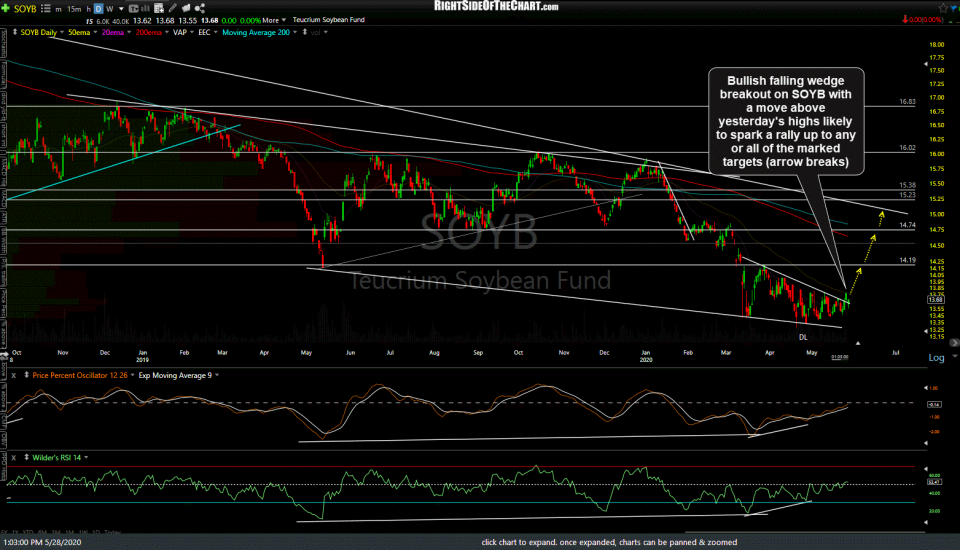

SOYB (soybeans ETN) broke out above this bullish falling wedge breakout yesterday with a break above yesterday’s high likely to spark a rally up to any or all of the marked targets (arrow breaks) on this daily chart.

/ZS (soybean futures) has been grinding sideways in a potential basing pattern with a buy signal to come on a solid break above the downtrend line. Should /ZS make a marginal new low anytime soon, it will be a divergent low (positive/bullish divergence) on this 60-minute chart.

JJG (grain ETN) is a one-and-done option for direct exposure to corn, wheat, & soybeans. JJG appears poised to rally on a solid break above this bullish falling wedge pattern with potential targets shown at the arrow breaks on this daily chart.