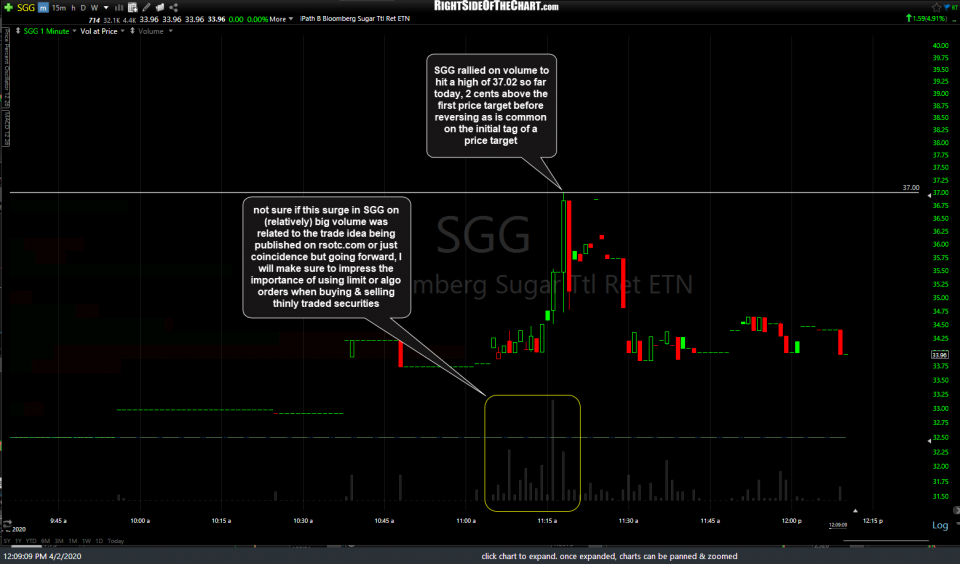

Well, that was quick. The SGG (sugar ETN) went on to hit the first price target, T1 at 37.00, for a quick (less than one day) gain of 12.4%. Previous & updated daily charts below (multiple charts in a gallery format, as below, will not appear on email notification but may be viewed on rsotc.com).

- SGG daily April 2nd

- SGG daily 2 April 2nd

No better time than the present to revisit a topic that has been discussed here many times in the past. If I wasn’t scrambling to get the trade idea on SGG out earlier in what was already a very time-consuming post to compose, with multiple charts & commentaries, the “better” time for this refresher would have been included with that post. What I am referring to is how to place orders on thinly traded stocks and ETFs/ETNs and more importantly, how not to trade them.

As a niche, relatively infrequently traded ETN, SGG, as well as CANE (another sugar ETN from a different issuer), are thinly traded, meaning that they typically don’t trade many shares each day. Spreads on thinly traded securities tend to be wider than actively traded securities such as SPY, QQQ, AAPL, MSFT, etc.., all of which normally trade with just a 1 cent spread between the Bid & Ask price (i.e.- the price at which a market order would be filled at if selling or buying at that given moment.)

The spreads on thinly traded stocks & ETFs can & will vary at times from relatively small to relatively large. For example, the spread on SGG is 33.80 x 34.46 as I type. As such, limit orders are preferable to market orders when buying or selling thinly traded securities as a market order can be filled at just about any price, even above the current asking price at the momentum you place the order. Not to get too deep into all the nitty-gritty but basically, XYZ stock might have an asking price of 52.50 yet you place a market order, only to find out that your order was filled at 53.10. What you need to understand is that the Ask price is A) not guaranteed and B) there might be a holder of XYZ that is trying to sell his or her shares at a limit order of 52.50, which is the reason for that Ask price you are seeing on the shares, yet they only have 100 shares why your order might be to buy 1000 shares. As such, your market order “should” be matched with their sell limit order at 52.50 but your remaining 900 shares will be filled at wherever the next potential sellers or the market makers are willing to sell you their shares & that price could be substantially higher, especially if there are not many willing sellers at the time.

As such, the best option for buying & selling thinly traded stocks & ETF/Ns are limit orders while I also like to use Interactive Broker’s Adaptive Algo Market & Limit Orders, which use an algorithmic program to “fish” your order around between the bid & ask price, typically splitting the difference, in an attempt to get you the best executive price. I’m not sure if other brokers have a similar feature & I don’t have any relationship with IB (other than having accounts with them) so something you might want to check into with your existing broker. You can click here for some info on how IB’s Algo orders work.

Although I have never noticed this with any thinly traded stocks or ETFs in the past, the timing of today’s spike in SGG does seem to indicate the possibility that buying from RSOTC subscribers may have lead to that spike which took SGG right up to that first price target & back down to just above where it was before the trade idea was published. Other than the quick pop up to T1 & subsequent pullback off that level, nothing has changed from a technical perspective nor for my outlook for the trade. SGG still offers an objective long entry here around the 33.80 level (as I type) with the next buy signal to come on a solid break above the 37.00 level.