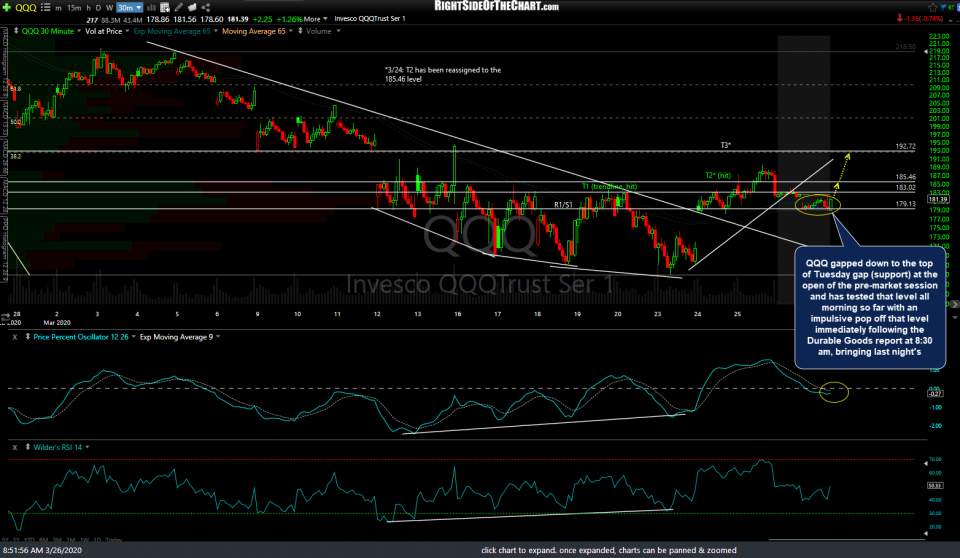

This first chart below is a screenshot from yesterday’s closing market wrap video highlighting my preferred scenario of more downside following the recent divergent highs on the 60-minute charts of the stock futures (/ES & /NQ), with a potential move down to test the top of Tuesday’s large gap (around 179) followed by a reversal & rally.

While I’m not completely sold on a continued move up to that potential 3rd price target (around 192.70), so far, QQQ tested & held that support all morning since gapping down to it at the open of the pre-market session & started to rally impulsively off the level at 8:30 am when the Durable Good report was released, coming in at the high-end of expectations.

The stock futures (/ES & /NQ 60-minute charts below) were good for about a 6%+ pullback off those divergent highs so with QQQ hitting & reversing off that key gap support, this may be the end of the pullback, at least for the near-term.

- NQ 60m March 26th

- ES 60m March 26th