Crude oil as well as the energy sector appears poised for an imminent correction. After hitting & exceeding the unofficial 3rd price target, XOP is now at rarely, if ever seen overbought readings & appears ripe for a pullback of at least 3-5% with a sell signal to come on a break below this 60-minute rising wedge pattern (2nd chart below):

- XOP daily Sept 27th close

- XOP 60-min Sept 27th close

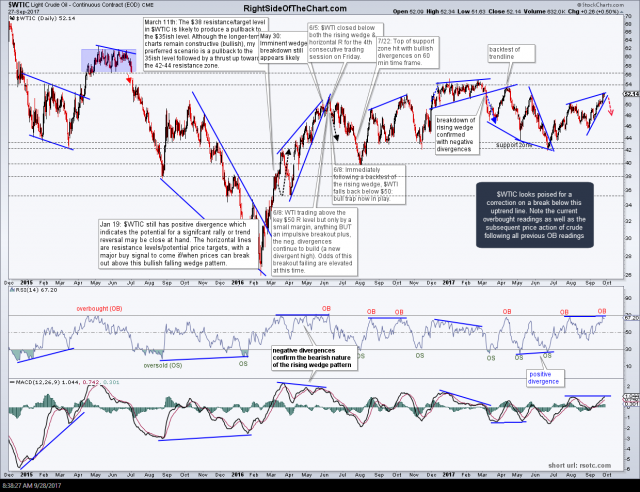

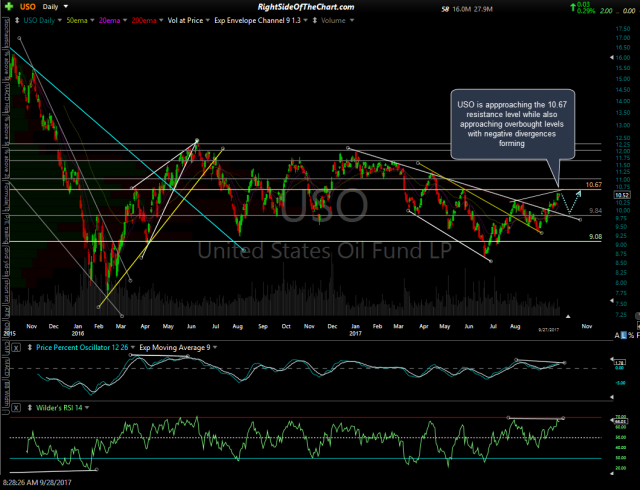

$WTIC (Light Crude Oil) looks poised for a correction on a break below this uptrend line. Note the current overbought readings as well as the subsequent price action of crude following all previous OB readings. /CL (crude futures) look poised for a pullback from the top of this price channel with strong negative divergences forming on the 60-minute chart below while USO (crude ETN) is approaching the 10.67 resistance level while also approaching overbought levels with negative divergences forming on the daily time frame. note: all charts except crude futures reflect prices as of yesterday’s close.

- $WTIC daily Sept 27th close

- CL 60-min Sept 28th

- USO daily Sept 27th close