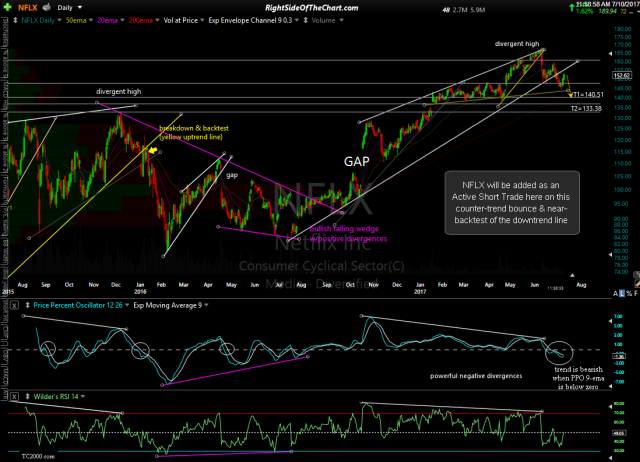

Wash, Rinse, Repeat. After the previous short trade on NFLX hit the final target, the stock experienced a typical reaction off that level followed by one more thrust lower while going on to put in a divergent low on the 60-minute time frame & recently breaking above this recent falling wedge pattern. With the stock now at resistance & close to backtesting the primary uptrend line on the daily time frame, NFLX appears to offer another objective short entry at this time. As such, NFLX (NFLX Inc.) will be added as an Active Short Trade here on this counter-trend bounce & near-backtest of the downtrend line. Price targets are T1 at 140.51 & T2 at 133.38 with a suggested stop on any move above 159.50. The suggested beta-adjusted position size is 0.90.

- NFLX 60-minute July 10th

- NFLX daily July 10th

For those with the fortitude to ride out the substantial counter-trend bounces along the way, this 15 year chart of NFLX lists some long-term downside targets that I believe will likely be hit in the coming year or two, with drop of at least 70% if my final target is reached.