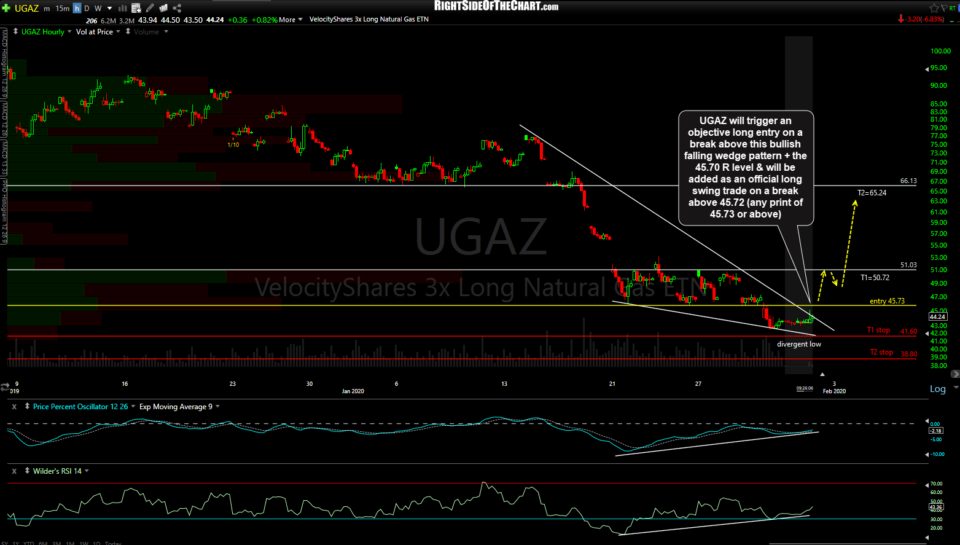

UGAZ (3x bullish natural gas ETN) will trigger an objective long entry on a break above this bullish falling wedge pattern + the 45.70 R level & will be added as an official long swing trade on a break above 45.72 (any print of 45.73 or above).

The price targets for this trade are T1 at 50.72 and T2 at 65.24. The suggested stop if targeting T1 is 41.60 or a suggested stop of 38.80 for those targeting T2. Due to the 300% leverage factor coupled with the extreme volatility of natural gas prices, the suggested beta-adjusted position size range is 0.25 – 0.35.

For those that prefer trading futures, /NG or /QG* will trigger an objective long entry on a break above the bullish falling wedge pattern + 1.853ish resistance level. *QG is the NYMEX MINY Nat Gas Futures contract which trades at the same price (hence, the same charts) of /NG but uses a smaller leverage factor; a multiplier of 2500 vs. 10,000 on /NG (i.e.- 1/4th the leverage). To calculate your net exposure to natural gas per contract, take the current price X the multiplier.