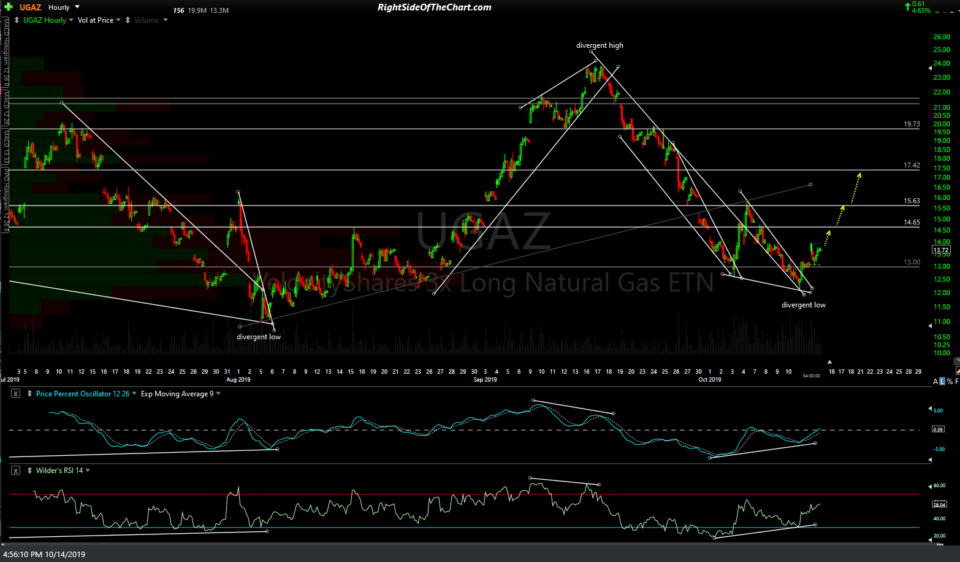

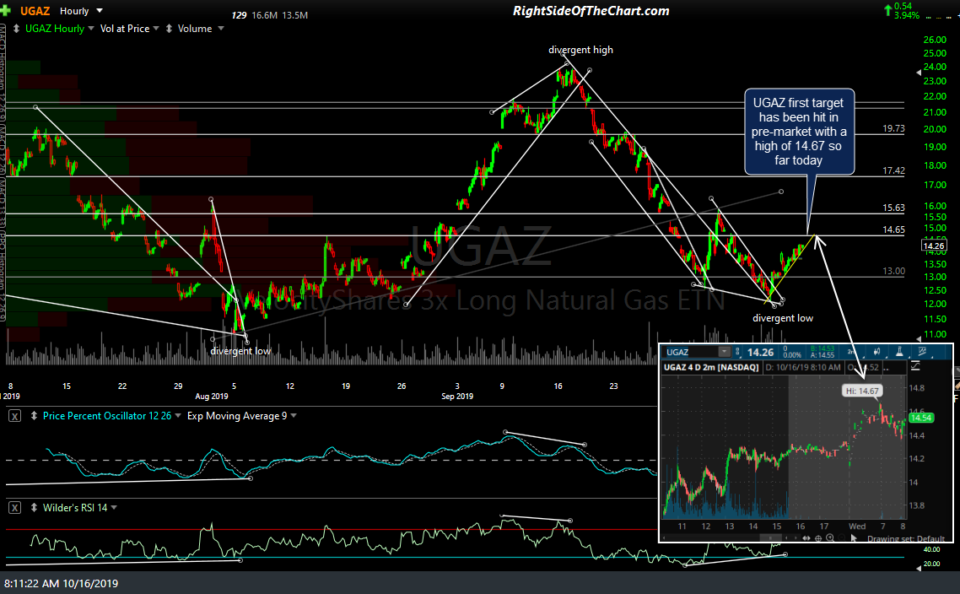

UGAZ (3x bullish natural gas ETN) has hit the first price target in the pre-market trading session with a high of 14.67 so far. Consider booking partial or full profits and/or raising stops if holding out for any of the additional targets. As of now, the charts still appear constructive & I continue to favor more upside to at least the next target (15.60ish) although be advised that the weekly nat gas inventory report, which quite often results in large & swift rips or dips, is scheduled for 10:30 am EST tomorrow. Previous & updated 60-minute charts (as of yesterday’s close with a 2-min chart with today’s pre-market trades overlaid) below.

- UGAZ 60m Oct 14th

- UGAZ 60m Oct 16th

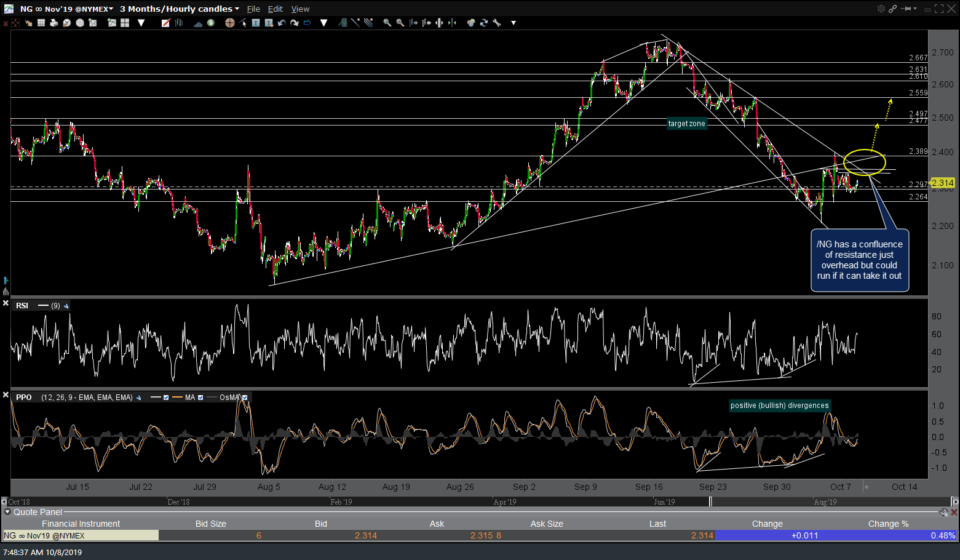

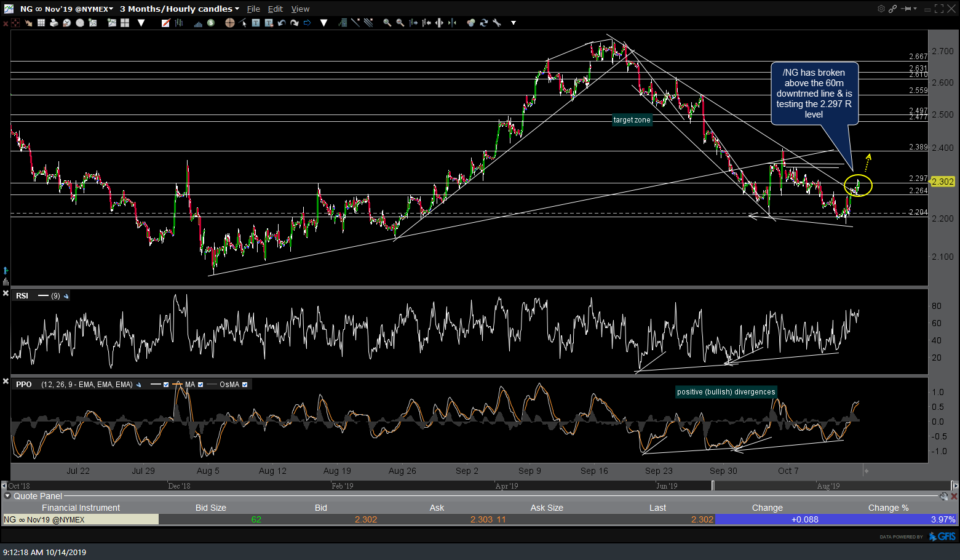

After the expected reaction around the 2.342 target, /NG (nat gas futures) has started to move above that resistance level & remains comfortable above the minor uptrend line for now with nat gas inventories scheduled for tomorrow at 10:30. Previous & updated 60-minute charts below starting with the Oct 1st chart which called for a rally of about 9% up to the downtrend line followed by a reversal (which is exactly what happened), followed by the Oct 8th chart highlighting the next buy signal to come on a breakout above the downtrend line as well as the additional overhead resistance levels up to the 2.389 price target which will still trigger an additional buy signal if/when taken out.

- NG 60m Oct 1st

- NG 60m Oct 8th

- NG 60m Oct 14th

- NG 60m Oct 16th