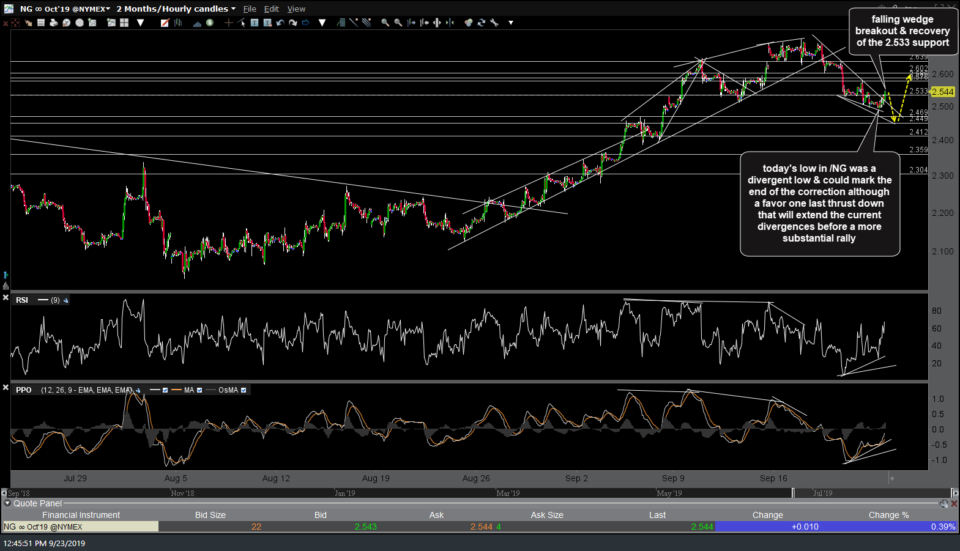

Today’s low in /NG (natural gas futures) was a divergent low & could mark the end of the correction although I favor one last thrust down that will extend the current divergences before a more substantial rally. While that may or may not prove to be the case, /NG did break out above this small falling wedge pattern followed by a recovery of the 2.533 support, both of which are near-term bullish technical events. As such, either this breakout will soon prove to be a false breakout/whipsaw signal (preferred scenario) or the real-deal, with more upside to come on nat gas.

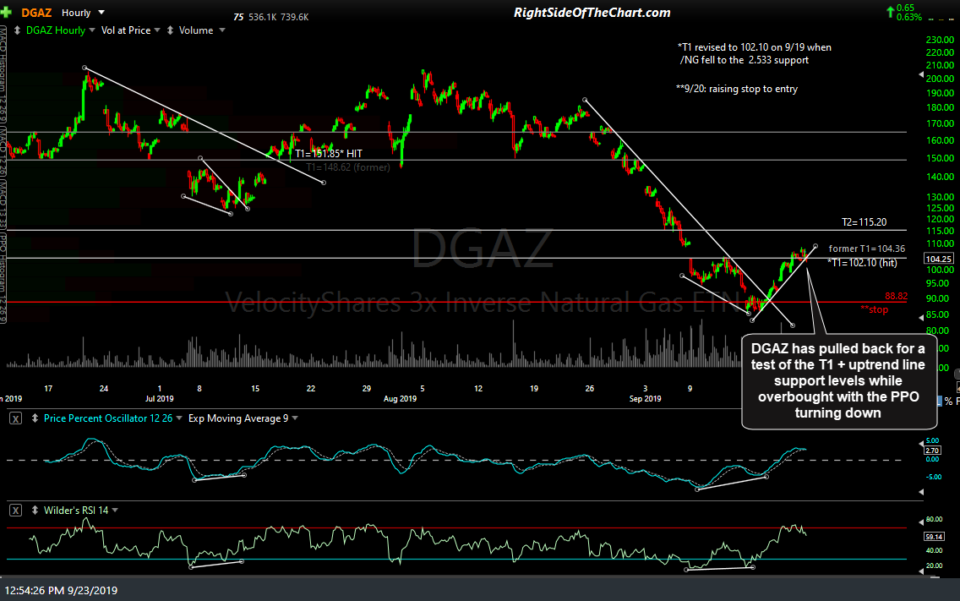

With that being said, I don’t see enough technical evidence to modify the trading plan for the official DGAZ (3x short nat gas ETN) swing trade at this time & will leave the trade paramters as is, with T2 at 115.20 and the suggested stop at the entry price of 88.82 to assure at least a breakeven on the trade for those that did not book partial or full profits at T1. Of course, one’s actual stop level should depend on their unique entry price/cost basis, preferred price target(s), risk/loss tolerance, etc..