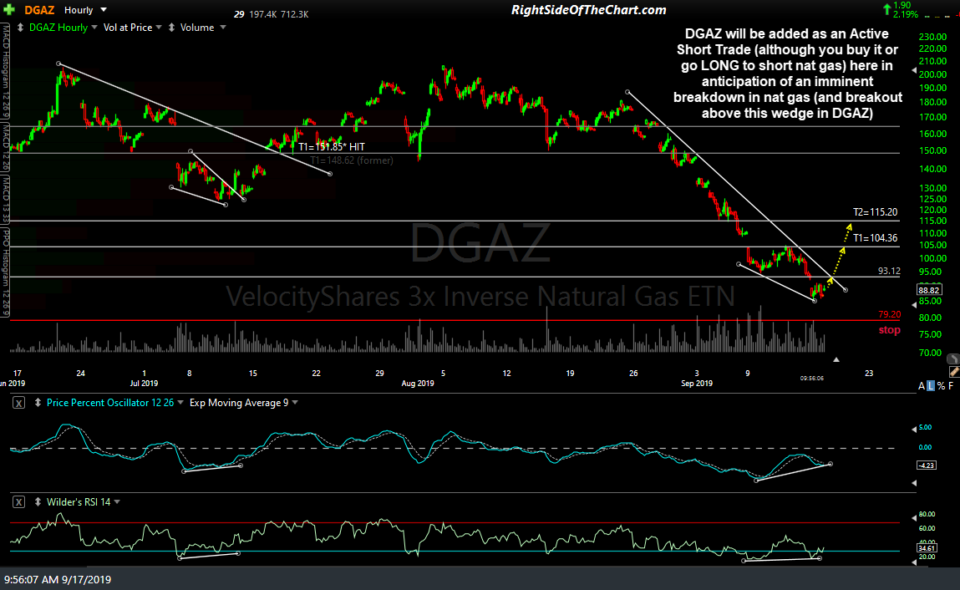

DGAZ (3x bearish/short natural gas ETN) will be added as an Active Short Trade (although you buy it or go LONG to short nat gas) here around current levels in anticipation of an imminent breakdown in nat gas and conversely, a breakout above this wedge in DGAZ. The trade parameters & previous notes for this trade can be viewed here.

I will also add that shorting natural gas, or any security for that matter, before a breakdown/sell signal is triggered in anticipation that it will soon do so is an aggressive trading strategy that runs a higher risk of the trade failing vs. the more conventional method of waiting for a sell signal/breakdown. As such, one might opt to wait for an impulsive breakout above the 93.12 + intersecting downtrend line resistance level as well as a breakdown below the comparable uptrend line posted on the /NG 60-minute chart earlier today before establishing a short on nat gas.