I’m just wrapping up day 2 of vacation & wanted to get a few charts out while I can. Just a reminder that I will be on vacation through July 3rd with very limited internet access, particular through the end of this week.

So far, we’ve had nothing but bearish candlesticks following Thursday’s Dragonfly Doji in SPY, which helps to confirm Thursday’s candles on all the major stock indices (not just SPY) as likely reversal candles.

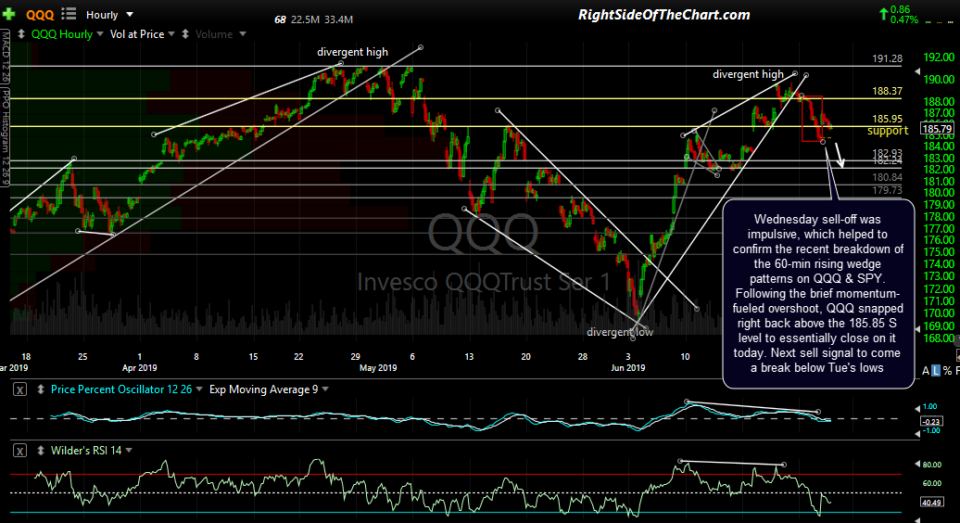

Wednesday sell-off was impulsive, which helped to confirm the recent breakdown of the 60-minute rising wedge patterns on QQQ & SPY. Following the brief momentum-fueled overshoot, QQQ snapped right back above the 185.85 support level to essentially close on it today. The next sell signal will come a break below Tuesday’s lows.

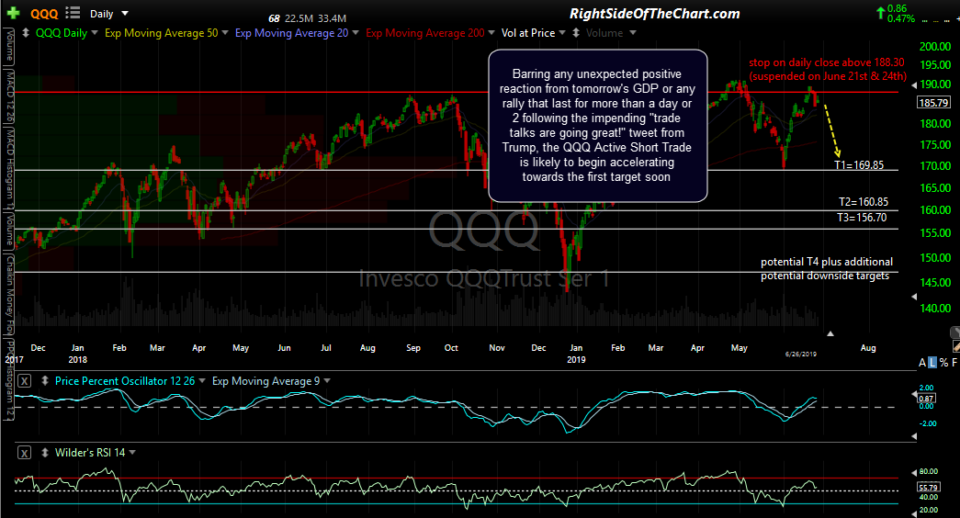

Zooming out to the daily charts, Tuesday’s large red candle took QQQ down to close around the 185ish support with the typical reaction (bounce) off that level today while the momentum indicators have started to roll over.

Barring an unexpected positive reaction from tomorrow’s GDP report or any rally that lasts for more than just a day or two before being faded following the impending “trade talks are going great!” tweet from Trump, the QQQ Active Short Trade is likely to begin accelerating towards the first target soon.