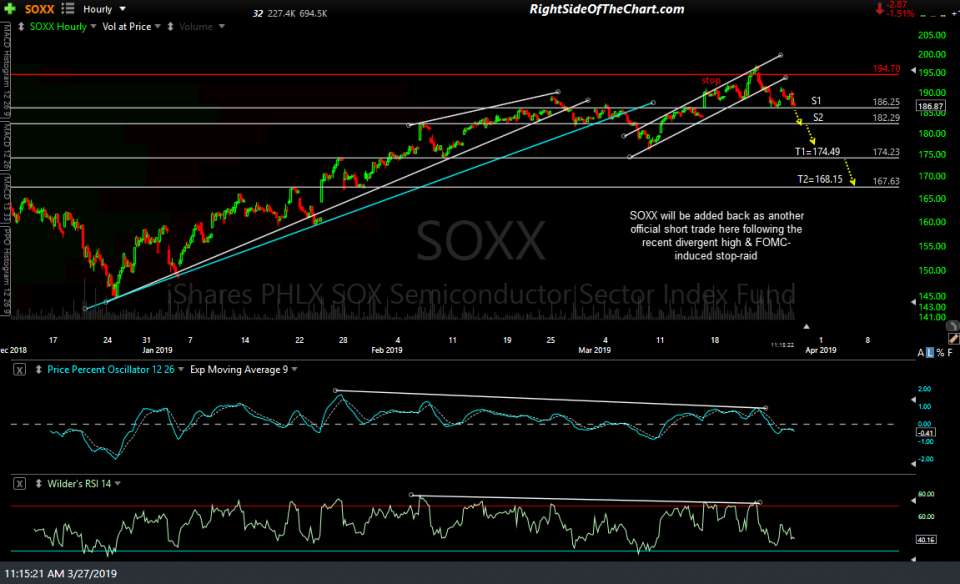

Same story as QQQ, the recent SOXX short trade had the stop clipped in the post-FOMC meeting “noise” that lead to the failed breakout in the broad market, undoubtedly clearing out a lot of short interest as the market popped high enough above the key SPX 2800 resistance level to run just about any well-placed stop-loss orders for short trades as well as suck in some new longs on what appears to be a breakout.

SOXX (semiconductor sector ETF) will be added back as another Active Short Trade here. Price targets for this trade are the same as the previous trade: T1 at 174.49 & T2 at 168.15 with the potential for additional targets to be added, depending on how the charts develop going forward. The suggested stop is any print of 194.70 with a suggested beta-adjusted position size of 0.9.