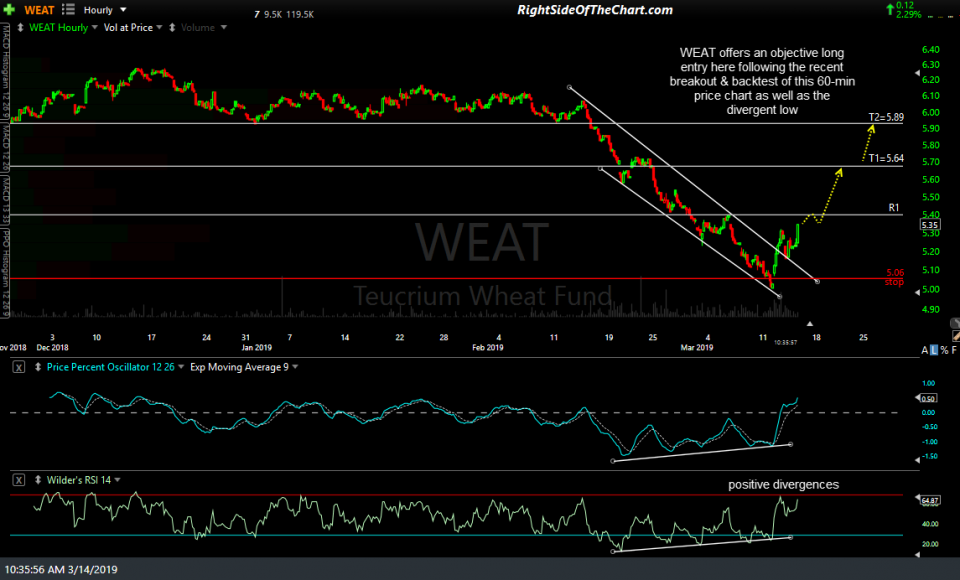

Based on the bullish technical case laid out in yesterday’s Wheat ETN Trade Setup post coupled with the fact that /ZW (wheat futures) continue to act bullish today, WEAT (wheat ETN) will be added as an Active Long Swing Trade as well as a Long-term Trade around current levels.

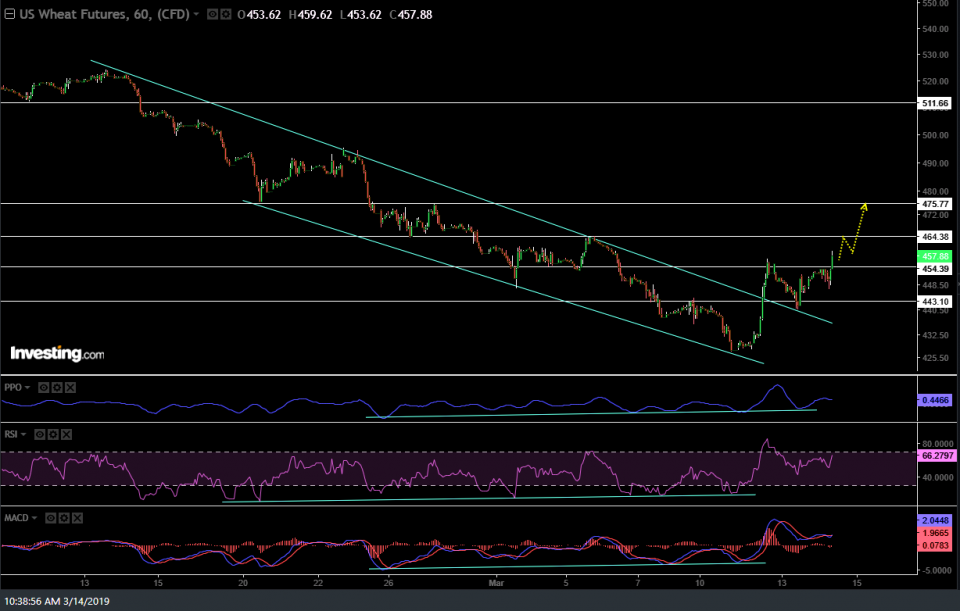

/ZW just took out yesterday’s reaction high following the breakout & successful backtest of the 60-minute price channel & divergent low with the next resistance/target around the 464.38 resistance level followed by the 475.77 level.

The current price targets for this trade are T1 at 5.64 and T2 at 5.89 although additional price targets will be added for the Long-term Trade. The suggested stop for the swing trade is any move below 5.06 while those looking at WEAT as a long-term/trend trade might consider using a more liberal stop as the price targets for the long-term trade will likely be 30% or more above current levels.

The suggested beta-adjusted position size for this trade is 1.0. Remember to check out our new Trade Position Size Calculator which can be accessed by the calculator icon on the main menu as well as under our new Resources page (also accessible on the top menu of the site).

Finally, keep in mind that CORN (corn ETN), which tends to move with wheat prices, is also under consideration as an official trade idea. If you plan to take both, that should be factored into the total position for both between both due to the typical correlation between the two.