I get quite a few inquiries on TSLA (Tesla Inc.) within the trading & most of my recent replies have been that the stock was trading in no man’s land (between key support & key resistance).

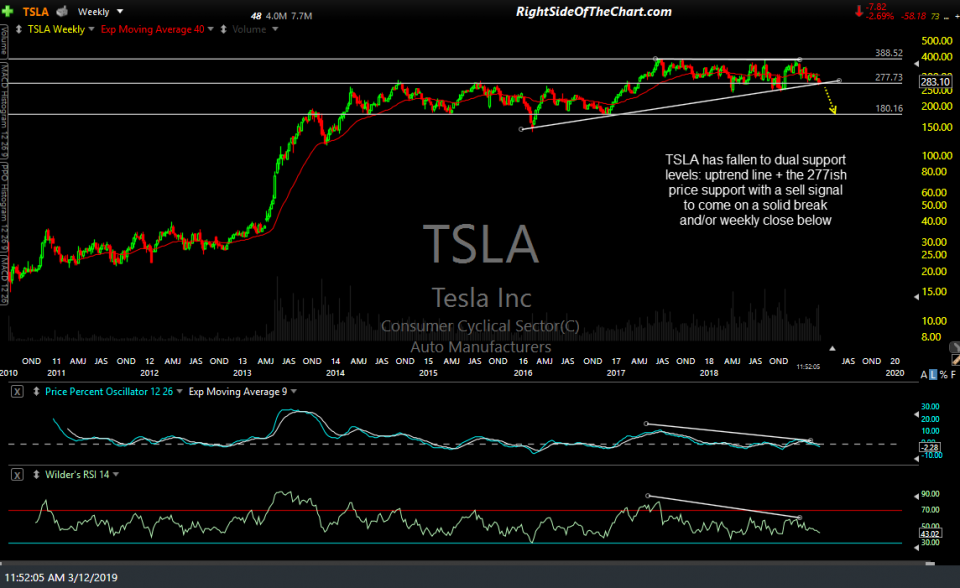

However, TSLA has now fallen to key intersecting price + trendline resistance on the weekly chart.

As I like to say, support is support until & unless broken so this drop to support can be viewed in one of two ways: Those bullish on the stock could take a long position here with a stop somewhat below those intersecting support levels while those bearish might look to position short on a very impulsive intra-week break and/or a weekly close below those dual supports.

Based on the technical posture of TSLA, including the strong negative divergences that were put in at the recent highs, I favor the bearish scenario and very much favor a price target around 180, about 35% below current levels, should the stock make a convincing breakdown on this weekly time frame. Should the stock hold support & rally from here, a logical price target would be the top of the early 2017-late 2018 trading range around 388.

As the daily chart is a bit of a mess with all of the choppy price action over the past year plus, some potential positive divergences forming on that time frame at this time, I am just passing this along as an unofficial or potential trade setup at this time. However, I will continue to monitor both TSLA & the other automakers for any significant developments & any objective trading opps.