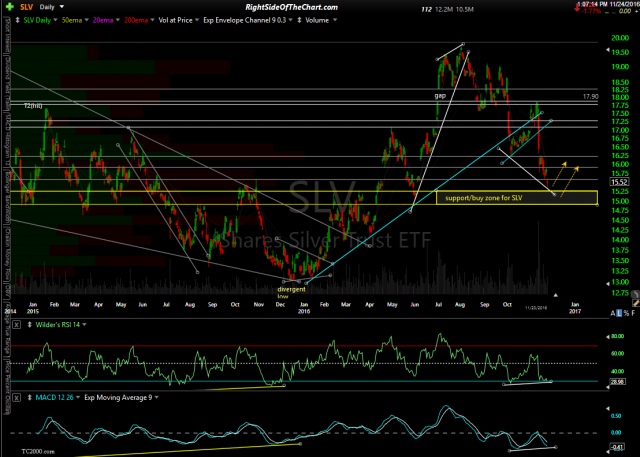

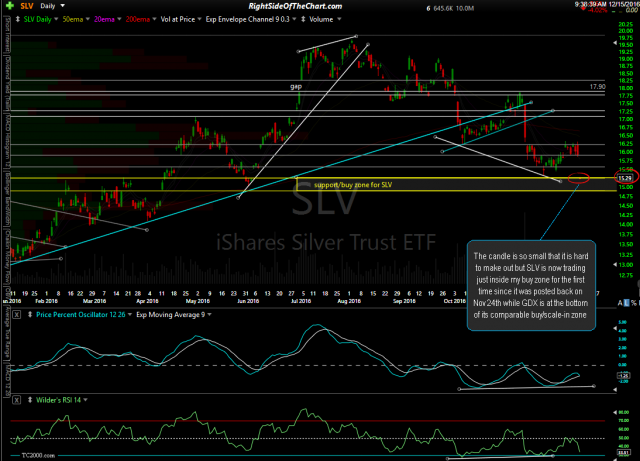

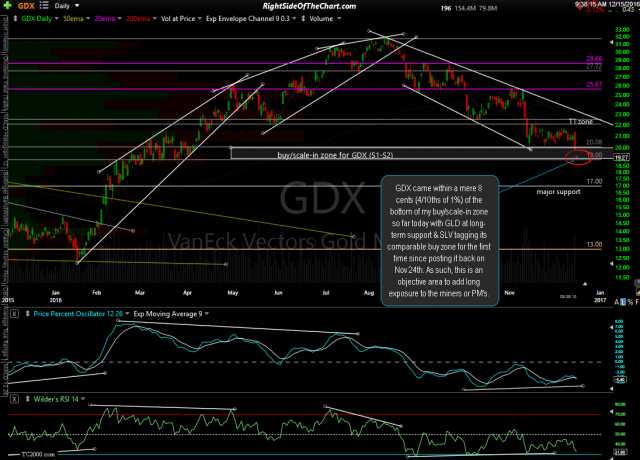

With the precious metals & miners gapping down sharply today, SLV (Silver ETF) is now in the buy zone for the first time since it was posted back on Nov 24th while GDX (Gold Miners ETF) is at the bottom of its comparable buy/scale in zone for the first time since then as well. (Nov 24th & updated charts below).

- SLV daily Nov 2th

- SLV daily Dec 15th

- GDX daily Nov 24th

- GDX daily Dec 15th

As of now, GLD, SLV & GDX are only unofficial long trade ideas as the precious metals & mining sector is still clearly in a downtrend showing absolutely zero evidence of a reversal. However, my confidence that the sector is close to at least a tradable bounce so I am passing this along for either aggressive swing traders that might want to take a shot at a long here or for longer-term traders that are interested in scaling into what could prove to be the next leg up in the sector.

As an unofficial trade & particularly due to the fact that when one is scaling in, they will have a unique cost basis depending on their average entry price, suggested stops are not provided but I can say that it is probably best to wait for some half-decent technical evidence of a reversal before taking a full position in GDX, GLD and/or SLV.