One sector that has seen tremendous growth & profitability in recent years has been the Pharmacy Benefit Managers (PBM). For a while now, I’ve been made acutely aware of the tremendous pricing pressure they have been exerting on the pharmaceutical companies (my wife works for a major pharmaceutical company) and while the major PBMs have benefited handsomely from such pricing leverage on the drug companies, all good things eventually must come to an end. Even if the PBMs continue to exert their strong pricing power on the drug companies, the charts are still clearly bearish by nearly all metrics that I follow.

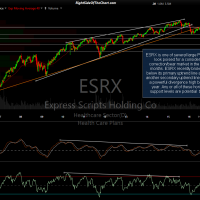

I’m not calling for a complete collapse of the PBMs, rather I’ve been following the charts of some of the leading PBMs, such as Express Scripts (ESRX), CVS Health Corp (CVS) and UnitedHealth Group (UNH), all of which now appear to have likely put in a major top. In fact, ESRX & CVS appeared to have put in a major top back in early 2015, after posted gains of well over 300% since their 2009 lows. ESRX has already fallen as much as 30% from its 2015 highs while CVS is currently trading about 24% off its 2015 highs with UNH the lone hold-out in the major PBMs, just recently printing an all-time high just a few months ago, albeit with strong bearish divergences on both the daily & weekly time frames.

While the profitability of these companies in recently years has been well known, as evidenced by the rise in their stock prices, I think that this article published in the Wall Street Journal yesterday can be viewed somewhat as an exposé, highlighting the fact that despite the PBMs claims of lowering drug prices, they are large responsible (at least according to the pharmaceutical industry) for the increase in drug prices in recent years. Maybe it’s time for the pendulum to swing in the other direction for a while.

- UNH weekly chart Oct 4th

- ESRX 6-day period 11-yr Oct 4th

- CVS 3-day period 6-yr Oct 4th

Any of, and most likely all three of these PBMs will likely be added as official short trade ideas soon but until then, the charts of each, along with some annotations & potential price targets, can be viewed above. The WSJ article Drugmakers Point Finger at Middlemen for Rising Drug Prices can be viewed by clicking here. Note: Depending on which device (mobile, computer, tablet) or browser this link is opened in, the article may or may not be locked for WSJ subscribers. If you are unable to view the entire article, let me know within the trading room & I might be able to provide instructions on how to access the publicly available version.