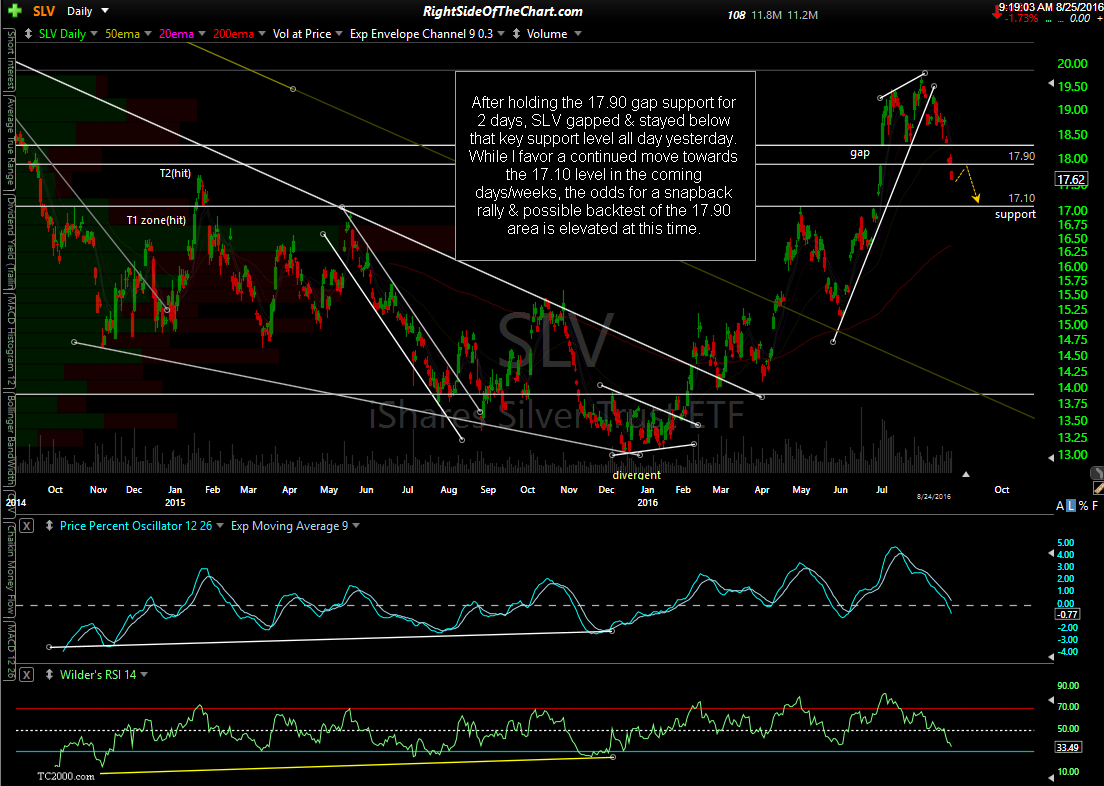

After holding the 17.90 gap support for 2 days, SLV gapped & stayed below that key support level all day yesterday. While I favor a continued move towards the 17.10 level in the coming days/weeks, the odds for a snapback rally & possible backtest of the 17.90 area is elevated at this time.

GLD GDX SLV SIL Update

Share this! (member restricted content requires registration)

1 Comment