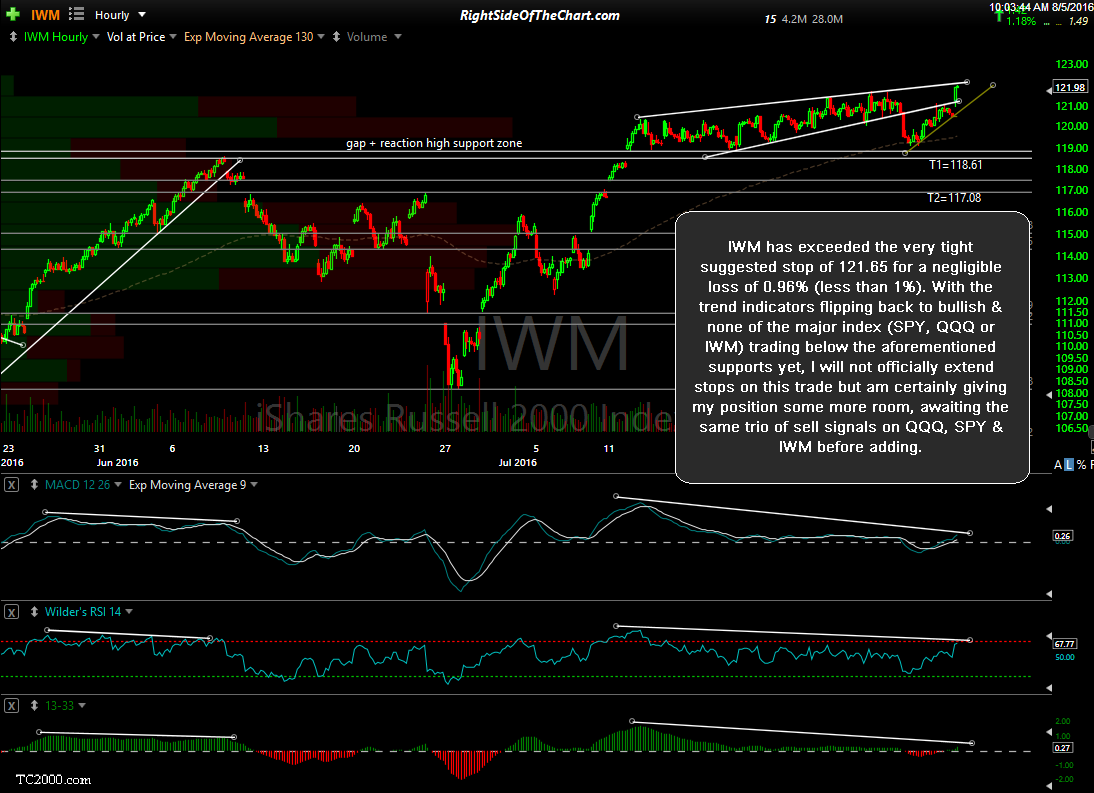

IWM has exceeded the very tight suggested stop of 121.65 for a negligible loss of 0.96% (less than 1%) as I continue to prefer unusually tight stops on any counter-trend official trade ideas lately. With the trend indicators flipping back to bullish & none of the major index (SPY, QQQ or IWM) trading below the aforementioned supports yet, I decided against officially extending the suggested stop on this trade but am certainly giving my position some more room, awaiting the same trio of sell signals on QQQ, SPY & IWM before adding & waiting at least until early next week or until the current bearish posture of the 60-minute & daily charts dissipates. IWM/TZA will be moved to the Completed Trades category. I will also add that IWM will likely be added back as an official trade idea very soon, should I see enough evidence in the charts to do so.

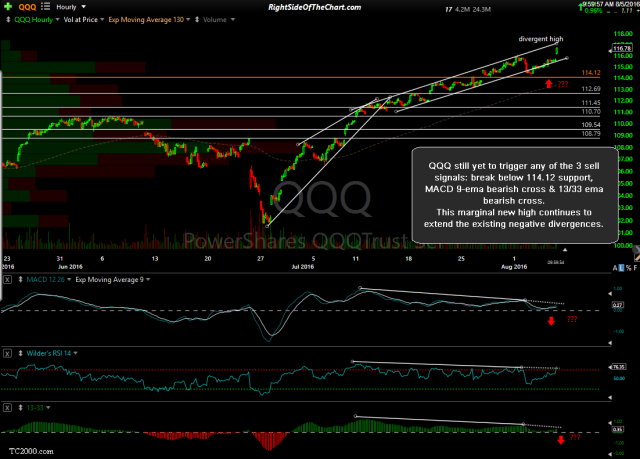

Negative divergences continue to build on this morning’s marginal new high on the SPY. Still awaiting a solid break below 215.30 along with confirmation on the QQQ 60 minute chart, as QQQ has been the leading index recently, still yet to trigger any of the 3 sell signals: break below 114.12 support, MACD 9-ema bearish cross & 13/33 ema bearish cross although I still highly favor a trigger of all of the aforementioned sell signals on all three indices any day now.

- SPY 60-minute Aug 5th

- QQQ 60-minute Aug 5th