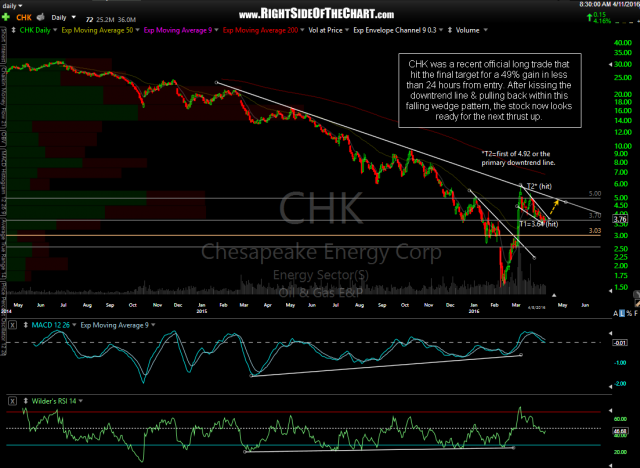

Ding-Ding! (As in the bell for round 2 in CHK that rang at the open today, or more accurately, started ringing in pre-market this morning when I highlighted the stock catching a nice bid in pre-market session). By all accounts, today’ price action appears to be the start of round 2, with the first round being that 1-day, 49% gain from the last (and official) trade on CHK about 5-weeks ago.

- CHK daily April 11th

- CHK daily 2 April 11th

This update is more for those that took a long position in CHK (Chesapeake Energy) today as even if the stock pulled all the way back to retest that wedge tomorrow, I would not add it as an official trade nor suggest taking it, as to erase today’s all of today’s clearly bullish price action would be extremely bearish. I’ve overlaid the same daily chart that was posted in pre-market earlier today with the 2-minute intraday streaming chart in which I noticed the stock moving today well in advance of the opening gap.

The second chart is as of the today’s close highlighting how this breakout happened to occur with a backtest of the zero on the MACD, which often acts as support when tested from above during an uptrend, and resistance when tested from below during a downtrend. If long CHK and only looking to position for possible quick trade up towards the 5.00 level, consider raising stops to the 4.18 or higher, depending on your entry price & stop allowance. CHK still looks promising as a longer-term trade & may likely be added as an official trade ideas if/when it appears to be poised to mount a solid & sustained breakout above that downtrend line & the 5.00 resistance level.