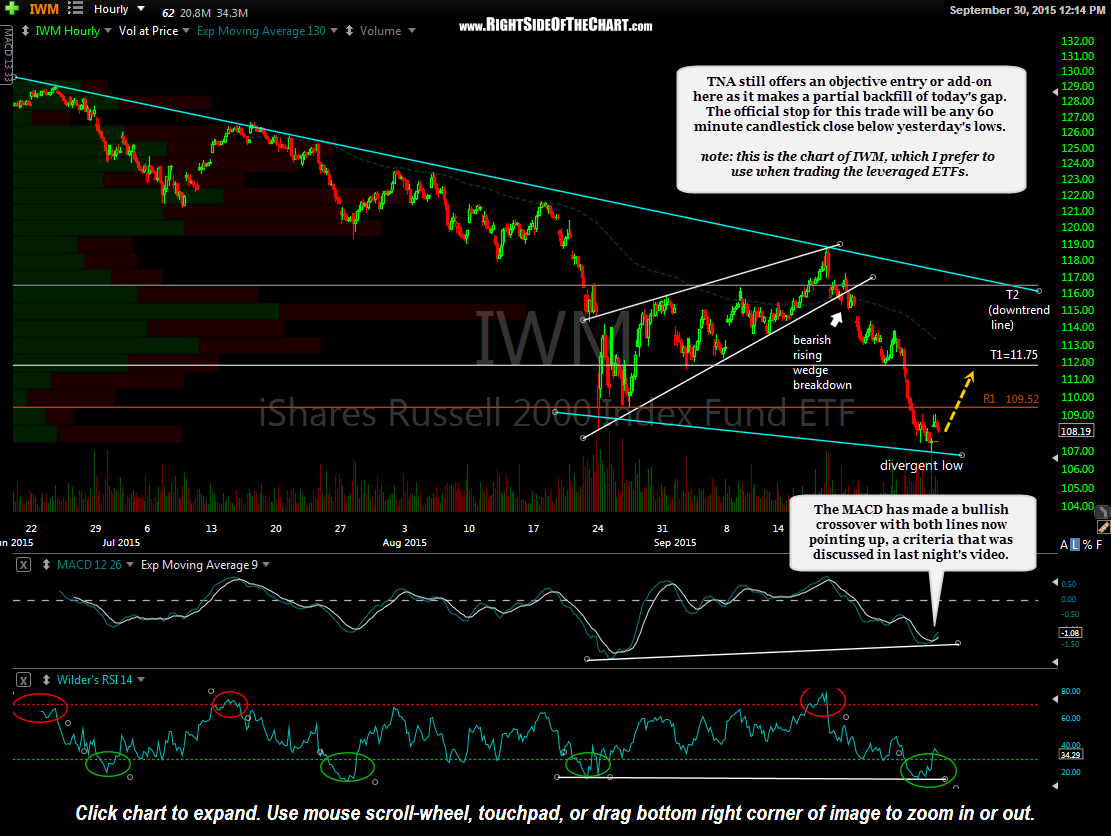

The suggested sell limits for the price targets & the suggested stop have been added to this updated 60-minute chart of IWM. TNA (3x long small cap ETF) still offers an objective entry or add-on here as it makes a partial backfill of today’s gap. The official stop for this trade will be any 60-minute candlestick close below yesterday’s lows. T1 is set at 11.75 with T2 the downtrend line.

Despite the healthy gaps higher in U.S. equities today and the fact that we now how confirmed positive divergence in place on the 60-minute time frame, this remains a counter-trend trade that still has some technical work to be done to firm up the near-term bullish case. As such, this should still be considered an aggressive trade although barring an unusually large opening gap down that far exceeds yesterday’s lows, a long entry here or taken before the close yesterday using the suggested stop offers an attractive R/R, should IWM/TNA go on to hit either price target.

note : I typically use the 1x tracking ETFfor determining entry & exit prices when trading any leveraged ETFs, in this case, IWM. The official trade idea remains TNA.