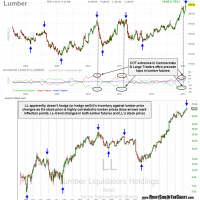

As the LL short trade failed to reverse following the opening gap today and remains above the previously suggested stop, I will consider the trade stopped out and removed from the Active Trades category. LL will remain on close watch for a re-entry as the long-term charts remain bearish. However, in order to keep those charts bearish, LL would have to reverse and close the week below current levels so as to keep the negative divergences intact. Due to the large gap today, the weekly MACD and RSI are threatening to take out the downtrend lines that define those divergences but it is the end of week (Friday close) that counts on that time frame. Also, just for reference, I have included the updated chart for lumber futures which shows a solid breakdown from from it’s primary uptrend line in place from Oct 2012. That updated chart is preceded by the previous LL vs. Lumber Futures chart that I posted back in February showing a very high correlation between tops in lumber futures and LL stock. So far, that past correlation has not played out but a reversion to the mean is likely to begin sooner than later.

As the LL short trade failed to reverse following the opening gap today and remains above the previously suggested stop, I will consider the trade stopped out and removed from the Active Trades category. LL will remain on close watch for a re-entry as the long-term charts remain bearish. However, in order to keep those charts bearish, LL would have to reverse and close the week below current levels so as to keep the negative divergences intact. Due to the large gap today, the weekly MACD and RSI are threatening to take out the downtrend lines that define those divergences but it is the end of week (Friday close) that counts on that time frame. Also, just for reference, I have included the updated chart for lumber futures which shows a solid breakdown from from it’s primary uptrend line in place from Oct 2012. That updated chart is preceded by the previous LL vs. Lumber Futures chart that I posted back in February showing a very high correlation between tops in lumber futures and LL stock. So far, that past correlation has not played out but a reversion to the mean is likely to begin sooner than later.