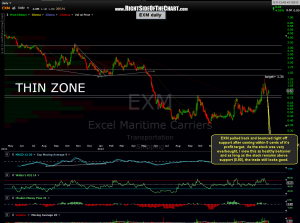

EXM recently pulled back and bounced right off support after coming within 5 cents of it’s profit target two weeks ago. As the stock was very overbought, I view this as healthy behavior and as long as the stock remains above support (0.80), the trade still looks good. As the entry price on this trade was 0.88, an objective stop would be on a move below 0.72 as that would provide both an attractive 3:1 R/R on the trade as well as placing the stop just below the bottom of the resistance zone. Those preferring more aggressive stops might consider any move below the top of the resistance zone, which was also the recent reaction low, at 0.80. Updated daily chart. For those interested in establishing a new position on this trade, please refer to the previous notes on this trade regarding the elevated risk/expected volatility and suggested position sizing.

EXM recently pulled back and bounced right off support after coming within 5 cents of it’s profit target two weeks ago. As the stock was very overbought, I view this as healthy behavior and as long as the stock remains above support (0.80), the trade still looks good. As the entry price on this trade was 0.88, an objective stop would be on a move below 0.72 as that would provide both an attractive 3:1 R/R on the trade as well as placing the stop just below the bottom of the resistance zone. Those preferring more aggressive stops might consider any move below the top of the resistance zone, which was also the recent reaction low, at 0.80. Updated daily chart. For those interested in establishing a new position on this trade, please refer to the previous notes on this trade regarding the elevated risk/expected volatility and suggested position sizing.