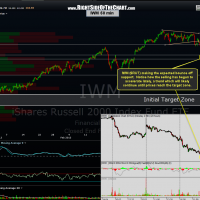

As a follow-up to the previous post mentioning some of the short trades still offering objective entries, keep in mind that one should never blindly buy or short a stock without referencing the chart first. When glancing at the charts just before I made that post, I noticed that several of those short trades were sitting right at or just above support, such as a former target that was hit before the stock bounced or in the case of the TZA/IWM trade, IWM was right at the 91.00 support level at which I had expected a bounce as diagrammed on the previous 60 minute chart posted Monday (first one below). Although I still expect that bounce to be limited in scope and duration, it would not make sense to add to a short position on the first approach of support from above. At this point, it would make sense to short the bounce or wait until that level clearly gives way before adding to an existing TZA position or establishing a new one. Previous & updated 60 minute IWM charts below.

As a follow-up to the previous post mentioning some of the short trades still offering objective entries, keep in mind that one should never blindly buy or short a stock without referencing the chart first. When glancing at the charts just before I made that post, I noticed that several of those short trades were sitting right at or just above support, such as a former target that was hit before the stock bounced or in the case of the TZA/IWM trade, IWM was right at the 91.00 support level at which I had expected a bounce as diagrammed on the previous 60 minute chart posted Monday (first one below). Although I still expect that bounce to be limited in scope and duration, it would not make sense to add to a short position on the first approach of support from above. At this point, it would make sense to short the bounce or wait until that level clearly gives way before adding to an existing TZA position or establishing a new one. Previous & updated 60 minute IWM charts below.