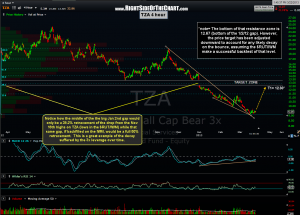

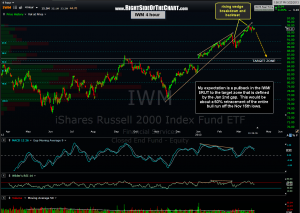

Here are the 4 hour period charts of both TZA and IWM, which of course are near mirror images of each other. As I expect the likely upcoming pullback to be relatively swift, I have opted to use the 3x leverage ETF as the preferred proxy for this short on the Russell 2000 index. As often mentioned here, leveraged ETFs are often prone to decay and tracking error (compared to the index that they are attempting to track).

Here are the 4 hour period charts of both TZA and IWM, which of course are near mirror images of each other. As I expect the likely upcoming pullback to be relatively swift, I have opted to use the 3x leverage ETF as the preferred proxy for this short on the Russell 2000 index. As often mentioned here, leveraged ETFs are often prone to decay and tracking error (compared to the index that they are attempting to track).

There are basically two primary factors that can exacerbate or minimize this decay: Time & Volatility. Basically, the longer you hold these leveraged ETF, the greater the decay will be. However, the volatility of the underlying index or sector can also be a very large contributing factor. The more volatile and choppy the underlying is, the worse the decay will be on the leveraged tracking etf. Therefore, if I were to expect a prolonged, choppy, back & forth move down to the 85-86 level in the IWM, I would most likely prefer to either directly short the IWM or use the 1x (non-leveraged) $RUT short etf, the RWM.

Many articles discussing this can be found via a quick web search but to illustrate this using a real world example, let’s just dig into these 4 hour charts on TZA and IWM. As you can see on the IWM chart to the right, my current target is that support zone defined by that very prominent gap from Jan 2nd. If that target is hit, the mid-point of that support zone lines up nicely with the 50% Fibonacci retracement level. In other words, the IWM will have given back half of it gains from the bull run that began with the Nov 16th lows. However, although the TZA chart (top) is virtually a mirror image of the IWM chart, if that same gap were to be backtested from current levels, TZA will have only retraced (i.e.- “made back”) 38.2% of it’s losses since the Nov 16th bottom. Had IWM moved in a straight line from the Nov 16th lows to where we are today, those retracement levels on IWM & TZA would essentially both be at 50% (not factoring in expenses, etc..)

Many articles discussing this can be found via a quick web search but to illustrate this using a real world example, let’s just dig into these 4 hour charts on TZA and IWM. As you can see on the IWM chart to the right, my current target is that support zone defined by that very prominent gap from Jan 2nd. If that target is hit, the mid-point of that support zone lines up nicely with the 50% Fibonacci retracement level. In other words, the IWM will have given back half of it gains from the bull run that began with the Nov 16th lows. However, although the TZA chart (top) is virtually a mirror image of the IWM chart, if that same gap were to be backtested from current levels, TZA will have only retraced (i.e.- “made back”) 38.2% of it’s losses since the Nov 16th bottom. Had IWM moved in a straight line from the Nov 16th lows to where we are today, those retracement levels on IWM & TZA would essentially both be at 50% (not factoring in expenses, etc..)

As of now I’m going to keep things simple and use only one target, 12.30, for the TZA trade. I have adjusted the target level down to well enough below that gap so that even if the $RUT does backtest it from above but TZA suffers from a modest amount of decay, that the odds for a fill should still be good. In otherwords, if the $RUT or IWM were to bounce of the top of that gap on a pullback, I would expect TZA to reverse just shy of it’s comparable gap. As the target on TZA is just about $3 from the entry price of 9.37, a stop $1 below entry would provide an objective 3:1 R/R ratio.

One final consideration would be to beta-adjust your position size accordingly if taking TZA. Being that this etf is leveraged 3x, one should therefore consider only taking about a third of their typical position size. If the $RUT were to drop 10% then TZA should be up by roughly 30% …and this cuts both ways (regarding losses). Also take into consideration that small cap stocks have a higher beta (are more volatile) than the broad market (S&P 500) as well.