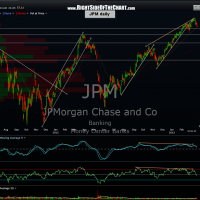

I’m considering shorting some of the large bank stocks but I’ll just share these charts as “unofficial” trade ideas for now, possibly adding them as soon as I clean up the Active Short Trades category. I’d like to cull out some of the Active Shorts that may not have triggered a stop yet, many of which are even profitable but just not offering as good a risk/reward profile at this point as I’d like to see. Therefore, I plan to remove some of those trades soon to make room for some new short ideas that offer a better R/R profile at this time.

Here’s the weekly chart of the $BKX (KBW Bank Index) along with the daily charts of three of the largest TBTF (Too Big To Fail) but not too big to short (or drop in price). TBTF means that the US Gov’t will do whatever it can in it’s power to keep the doors open and lights on at the banks but in no way (contrary to the widely held belief of the general public) does this mean that the stock price of these banks is immune to significant losses and even the possibility of a total loss, should another financial crisis occur in the future. GM is one of many examples of this. The Gov’t essentially bailed out GM and kept the lights on for the company while the GM stockholders, prior to the 2009 bankruptcy, were wiped out. The GM shares that trade today were NEW shares from the post-bankruptcy company and the previous stockholders were not compensated or given any stake in the new company. Anyway, I’m not predicting any major collapse of the bank stocks, at least not at this point in time. Just looking for a likely 15-20% drop (possibly more) from their recent highs. $BXK weekly chart followed by the daily charts of JPM, BAC, and C: