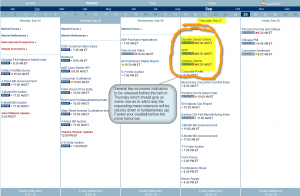

although we could very well get some volatility tomorrow, be aware that we have several key market moving economic releases due out before the bell on thursday. therefore, more “risk-adverse” traders (if that’s not an oxymoron) might consider lightening up or hedging some of their positions before the close tomorrow.

although we could very well get some volatility tomorrow, be aware that we have several key market moving economic releases due out before the bell on thursday. therefore, more “risk-adverse” traders (if that’s not an oxymoron) might consider lightening up or hedging some of their positions before the close tomorrow.

i continue to maintain the belief that a powerful reversion to the mean is likely to commence soon; either stocks down as (if) the recent trend in deteriorating fundamentals in the US economy is re-affirmed going forward -OR- the fundamentals improve sharply, catching up to the recent ascent in stock prices over the last several months. my primary scenario remains the former (stocks down) with my alternative scenario still a blend of the two (stock prices stall in a trading range while the fundamentals show an overall trend of modest improvement). only a sharp, broad based improvement in fundamentals (my lowest probability scenario) would justify substantial gains in stock prices (15%+) from current levels by year end. i know that forecasting price moves of the market within specific time parameters is a fool’s errand but here’s my best guess for the US stock market returns (from current levels) by year-end*:

- a decline of 15% or greater: 65%

- a sideways trading range of less than 15% below and/or 15% above current levels: 30%

- a gain of 15% or greater: Less than 5%

*These predictions are not where I expect the market to be on December 31st, just how much it will likely go up or down (at it’s peak) before then. Although certainly possible, I do not think that it is likely that both the first and third scenarios play out (i.e.- the stock market experiences a drop AND a gain of over 15% from current levels by year-end).