Both the SPY & QQQ have broken above the top of the previously highlighted 15-minute bearish rising wedge patterns with IWM current trading at the top of its 15-minute wedge pattern. All three of these index tracking ETFs remain on short-term buy signals (15-minute MACD & 28/68 ema pair) for now and although these upside breaks certainly dampen the near-term bearish outlook for the US equity markets, the bearish intermediate & longer-term technical outlook on the daily & weekly time frames remains unscathed at this time.

Over the years, I’ve often discussed & highlighted one of the most powerful technical developments signals in trading and that would be a wedge overthrow. Wedge overthrows (or overshoots) occur when prices within a bullish or bearish wedge pattern unexpectedly break in the opposite direction that anticipated. In this case, that is a break above the top of the bearish rising wedge patterns on the 15-minute charts. If these upside breakouts do indeed prove to be only temporary overshoots of the wedge patterns, then we would likely see prices fall back into the wedge in the coming hours or days (probably not much more than a couple of days, based on where prices are relative to the pattern), followed by very impulsive selling leading to a break & sustained move below the wedge patterns.

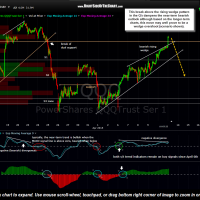

- QQQ 15 minute April 13th

- SPY 15 minute April 13th

- IWM 15 minute April 13th

Now all that is a big IF and although I can’t advise anyone on how to trade, I can share my thoughts. Shorting or adding to a short on this upside break is not objective. Although occasionally I will short or add to a short on a wedge overthrow if I am highlight confident that it will play out, it would be prudent to wait for both the SPY & QQQ to move back within the patterns before shorting or adding to a short position. Doing so would only cost a few basis points (in percentage terms) on your entry price & while considerably increasing the odds of success on the trade vs. shorting while prices are above the pattern.

Just to clarify, today’s price action does not alter the original suggested stop parameter for the QQQ swing short trade. That position was initiated on March 18th at 107.91 and with the Q’s trading at 108.26 as I type, the trade is only at a very slight loss (just 3/10th of 1%). The suggest stop for that trade remains 111.

The recent TWM short, just added on Wednesday at a price of 35.04, did exceed the suggested stop of a move below 34.50 (which means a print 34.49) but literally buy a mere penny so far today (LOD 34.48). For the sake of being consistent with the trade parameters, I will consider that trade stopped out although I personally remain short & bearish on IWM (bullish TWM). That gives the TWM trade a loss of only 1.6% (somewhat higher if TZA was used, but still a very negligible loss).

To summarize, I do not believe that shorting into today’s pop in the equity markets is objective although an objective entry could prove to be close at hand, should today’s rally be faded to the point that all major US stock indices give back all of today’s gains.