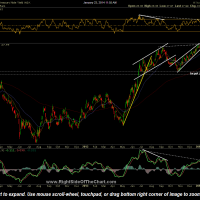

A link to the live, annotated chart of TLT (iShares Barclays 20+ Year Treasury Bond Fund ETF) has been added to the Live Charts Links page. A link to that page has also been added to the gray navigation menu at the top of the home page as well. As the screenshot of the TLT chart below illustrates, treasury bonds recently broke out of a bullish falling wedge pattern, complete with positive divergences in place at the recent lows. Although the measured target for the pattern would put TLT somewhere around the 115 area, my current price target runs from about 109 to 109.75ish and also correlates with my long-standing downside targets for $TNX (10-year treasury note yield index) and $TYX (30-year treasury bond yield index). note: Those targets have been slightly revised to target zones, with the lower end of the zones defined by the previous downside targets).

As far as fixed-income instruments go, Treasuries and High-Yield (Junk) bonds are at the opposite ends of the spectrum. Treasuries offer the highest degree of security (lowest risk) with the lowest yields. Junk bonds offer the highest yields of US debt instruments but are associated with the highest risk of defaults. While treasury bonds prices are highly correlated with prevailing interest rates, junk bonds are much less interest-rate sensitive and affected more by the business cycle as defaults typically increase during recessions and abate during economic expansions. As such, junk bonds are highly correlated with equity prices (the stock market) while treasury bonds have a high inverse correlation with interest rates (the last few years seeing an unusual disconnect from that historical correlation due to quantitative easing). Essentially, the charts above look to indicate more upside in treasury bond prices (yields lower) while the high-yield sector looks to be poised for a substantial correction should prices make a solid and sustained break below the bearish rising wedge pattern. If that were to happen, the equity markets would most likely experience a substantial correction as well.